June 27, 2025

In many organizations, the interval between issuing an invoice and receiving payment can stretch beyond two months, locking up funds that could support new orders, technology investments, or market expansion. Relying on manual processes, multiple lender relationships, and disconnected systems only adds complexity, delays approvals, and increases the true cost of capital.

To make a well-informed choice, you need more than headline rates. Instead, you need a practical, technology-driven approach that fits your business operations and financial goals. Equally important is understanding the right moment to adopt or switch to a more effective SCF platform.

In this guide, we’ll walk you through both: the how and the when.

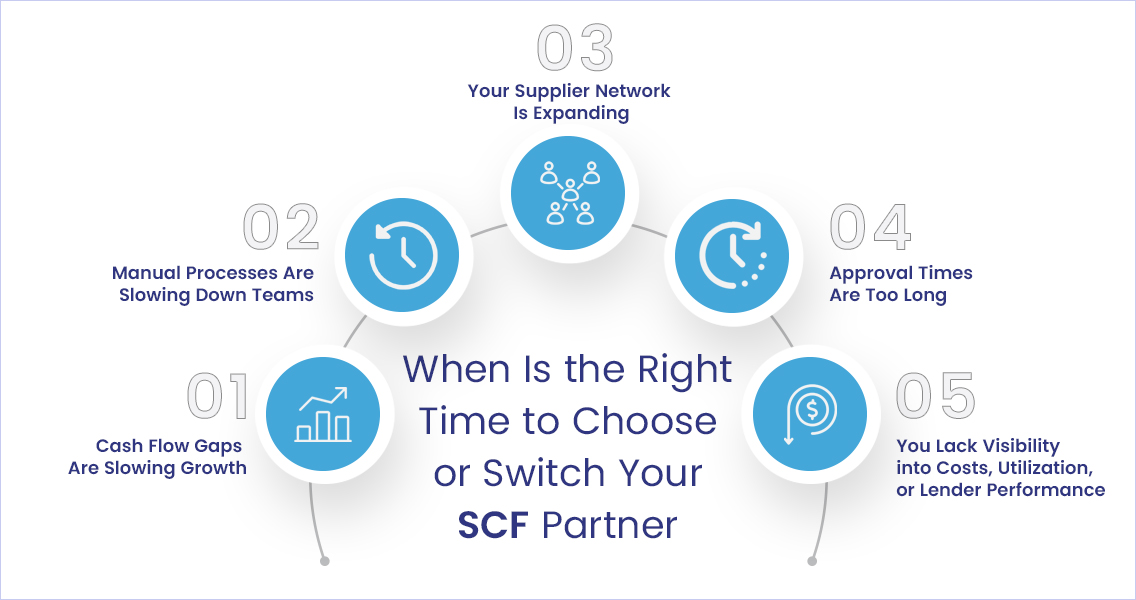

When Is the Right Time to Choose or Switch Your SCF Platform?

Many businesses delay the change until pain points become unavoidable. Some clear signs it’s time to adopt or revisit your SCF setup include:

- Cash Flow Gaps Are Slowing Growth: If increasing sales are followed by working capital strain due to delayed customer payments, your current setup may not be keeping pace with demand.

- Manual Processes Are Slowing Down Teams: If your finance or procurement teams are spending too much time managing spreadsheets, reconciling payments, or coordinating with multiple lenders, a streamlined SCF platform could free up critical bandwidth.

- Your Supplier Network Is Expanding: Growth in your dealer, distributor, or vendor network creates more financial complexity. A modern SCF solution scales with you and ensures supplier confidence with timely financing.

- Approval Times Are Too Long: When invoice approval to disbursement is taking too long due to manual intervention or lack of lender responsiveness, it’s time for a smarter platform.

- You Lack Visibility into Costs, Utilization, or Lender Performance: If your current system doesn’t show you real-time data on outstanding financing, upcoming repayments, or partner performance, your decision-making is likely based on incomplete information.

How to Evaluate the Right SCF Platform Partner for Your Business

Choosing the right supply chain finance partner requires carefully assessing several critical factors. Beyond just offering financing, the ideal platform should seamlessly fit into your operational ecosystem, support your growth ambitions, and provide transparency and security at every stage.

- Access to a Wide Network of Lenders: A strong SCF partner provides access to multiple banks and NBFCs through a single digital platform. This eliminates the need for separate negotiations and multiple application processes, allowing you to quickly compare offers and select the most suitable financing option tailored to your credit profile and business needs.

- Centralized Interface and Simplified Operations: An intuitive and unified digital interface centralizes your suppliers, distributors, and dealers within one system. This streamlined approach reduces operational complexity, eliminates reliance on scattered spreadsheets, and ensures better visibility and control over invoices, payments, and approvals.

- End-to-End Digital Workflows and Automation: Automating key processes, from invoice approval and funding disbursement to collections, dramatically reduces manual intervention and operational errors. Fully digital workflows provide real-time updates and automated alerts, ensuring transparency and informing all stakeholders at every step.

- Smart Borrower-Lender Matching with Advanced Risk Management: Leveraging data-driven credit profiling, an effective platform intelligently matches borrowers to suitable lenders, increasing approval rates and minimizing manual underwriting delays. Advanced risk management tools such as real-time eligibility checks and fraud detection capabilities further secure your transactions and compliance.

- Robust Technology and ERP Integration: The right SCF partner seamlessly integrates with your existing ERP and accounting systems via secure APIs, eliminating duplicate data entry and manual reconciliation. This integration enhances accuracy, efficiency, and real-time financial management, ensuring smooth operations across your entire financial ecosystem.

- Transparent Costs and Clear Pricing: Your SCF platform should offer clear, upfront details about costs, fees, and interest rates, allowing you to assess true financing expenses accurately. A transparent pricing structure helps avoid hidden charges and ensures predictable financial planning.

- Comprehensive Reporting and Monitoring: Real-time dashboards and detailed reporting capabilities give instant insights into financing activities, transaction statuses, and repayment schedules. Robust reporting tools help identify trends, spot potential issues early, and support informed, data-driven decisions.

- Data Security and Compliance: Given the sensitive nature of financial data, a secure SCF platform must employ stringent data security protocols and compliance practices. Look for features such as encryption, access controls, regular audits, and adherence to evolving regulatory standards to safeguard your information effectively.

- Scalability and Rapid Implementation: The ideal platform can easily scale alongside your business growth, effortlessly accommodating increased transaction volumes and expanding networks. Quick and straightforward implementation reduces downtime, enabling your team to start benefiting from improved cash flow management without long onboarding processes.

- Flexible Financing Options and Expert Advisory: Different supply chain participants have varying financial needs. Your SCF partner should offer customized solutions such as invoice discounting, factoring, and reverse factoring, supported by access to expert financial advisors who can help you strategically optimize your funding programs and enhance relationships with suppliers.

Checklist for Preparing Your Business Before Adopting an SCF Solution

Adopting a supply chain finance solution requires internal readiness to leverage its benefits and ensure a smooth transition. Before you commit to an SCF partner, consider the following checklist:

- Align Your Finance, Procurement, and IT Teams: Engage all relevant teams early to clarify roles, set expectations, and prepare for process changes involved in SCF adoption.

- Define Clear Financing Objectives and KPIs: Establish what you want to achieve with SCF—reducing days sales outstanding (DSO), improving supplier satisfaction, or lowering financing costs—and how you will measure success.

- Evaluate Supplier Readiness and Communication Plans: Determine which suppliers will participate and how you will communicate the benefits and processes. Early supplier buy-in accelerates adoption and reduces friction.

- Ensure Compliance and Risk Management Readiness: Review your regulatory obligations and risk policies related to financing. Confirm your SCF partner can support your compliance requirements and data security needs.

Bringing It All Together: A Future-Ready SCF Platform

Choosing the right supply chain finance partner comes down to four essentials: deep integration, clear visibility, streamlined processes, and the ability to grow with you. The ideal solution plugs into your ERP, automates processes, and scales as your transaction volumes increase—without adding new silos or manual steps.

Loan Frame’s SCF marketplace does just that. By linking your billing system to a wide network of top Indian banks and NBFCs, it lets you submit invoices in a few clicks and receive funds without chasing paperwork. A unified dashboard shows each transaction’s status, fees, and repayment schedule, so you always know where your cash stands. Whether you opt for invoice discounting, factoring, or reverse factoring, you’ll follow the same simple flow, no extra complexity as your needs evolve.

Book a demo to see how our SCF platform works, tailored to your business.