July 18, 2025

Distribution finance is more than just a funding solution – it’s a catalyst for faster growth, stronger partnerships, and a more resilient supply chain. By offering customized working capital solutions against invoices or purchase orders, it ensures that your distributors, dealers, and retailers have the liquidity they need to keep goods moving – without stretching your balance sheet.

For corporates, a well-financed distribution network means faster inventory turnover, stronger channel loyalty, better negotiation power with suppliers, and a greater ability to meet dynamic customer demand. This agility strengthens overall supply chain operations, protects margins, and drives consistent business growth across the entire distribution ecosystem.

In this blog, we provide a complete overview of distribution finance – what it is, how it works, and why it matters for companies aiming to scale their distribution networks, optimize working capital, and build future-ready supply chains.

What is Distribution Finance?

Distribution finance is a specialized working capital solution that enables distributors, dealers, and retailers to purchase inventory without immediate out-of-pocket payments. It bridges the financial gap between the sale of goods by corporates and the final payment from end customers.

Rather than tying up their own cash reserves or delaying procurement until customer payments arrive, distributors access short-term credit facilities to stock up, sell faster, and grow sustainably.

The primary purpose of distribution finance is to keep the supply chain moving efficiently. It ensures that cash flow constraints at the distributor or dealer level do not disrupt product availability or sales velocity. By unlocking liquidity where needed most, corporates can maintain higher inventory turnover, meet customer demand more reliably, and strengthen their overall market presence.

Key stakeholders include:

- Corporates: Initiate financing arrangements to support their distribution partners and accelerate sales.

- Distributors and Dealers: Access flexible credit facilities to procure inventory without cash flow stress.

- Financial Institutions: Banks, NBFCs, and fintech lenders that provide the financing, manage risks, and ensure seamless fund flows.

How Distribution Finance Works

- Credit Extension: Corporates collaborate with financial institutions to establish a structured financing program. Distributors are evaluated based on predefined criteria such as business vintage, turnover, past performance, and repayment track record, and a suitable credit limit is assigned.

- Goods Procurement: Distributors use the approved credit line to place orders with the corporate, securing inventory without needing upfront payments. This empowers them to meet demand proactively rather than reactively.

- Disbursement and Supply: Upon order confirmation, the financial institution disburses payment directly to the corporate. The corporate dispatches goods to the distributor as per standard commercial terms, ensuring business continuity without financing delays.

- Sales and Repayment: After selling the inventory, the distributor repays the financing within the agreed credit period—typically 30, 60, or 90 days. Some arrangements even allow flexible repayment linked to real sales cycles, offering further cash flow comfort.

Role of Corporates and Financial Institutions

Corporates usually act as facilitators rather than direct lenders. By partnering with banks, NBFCs, or fintech lenders, they enable distributors to access affordable credit easily while ensuring they themselves are paid upfront.

Financial institutions manage the underwriting, fund disbursement, monitoring, and collections, thus reducing credit risk exposure for corporates and simplifying operations for distributors.

This structure ensures that while goods keep moving, cash flow cycles stay healthy for all parties involved.

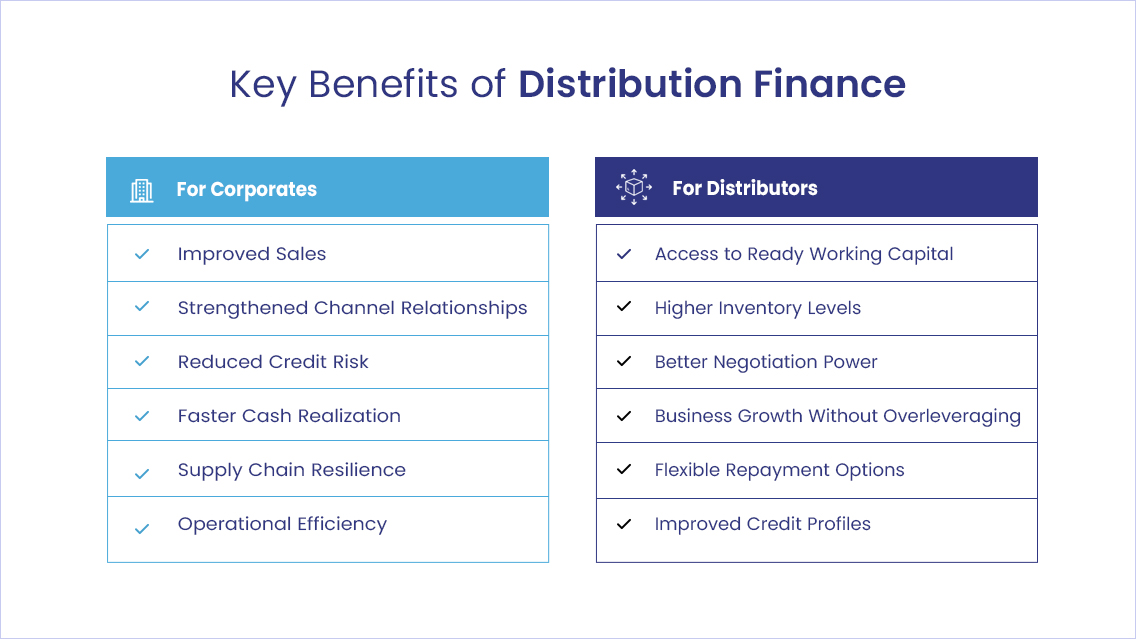

Key Benefits for Corporates

Implementing a distribution finance program offers several strategic benefits for corporates:

- Improved Sales: Distribution finance empowers distributors and dealers to stock more inventory without waiting for internal cash generation. This leads to faster order placements, higher sales volumes, and quicker market penetration for corporates.

- Strengthened Channel Relationships: By enabling easier access to credit, corporates directly support their channel partners’ growth. This builds stronger loyalty, deeper partnerships, and longer-term distributor engagement—giving corporates a competitive advantage in the marketplace.

- Reduced Credit Risk: Since banks, NBFCs, or financial institutions typically underwrite the distributor financing, corporates can minimize their direct exposure to distributor defaults. Payments are secured upfront, improving financial predictability and reducing the credit management burden.

- Faster Cash Realization: Corporates receive payments directly from the financial institution once the goods are dispatched, rather than waiting for distributors to pay over extended credit cycles. This improves cash flow and working capital efficiency without impacting balance sheets.

- Supply Chain Resilience: A financially strong distribution network is better equipped to handle market fluctuations, demand surges, and economic disruptions. Distribution finance ensures your channel partners maintain healthy inventory levels and consistently serve customers—even in challenging conditions.

- Operational Efficiency

With financial institutions handling credit assessment, collections, and repayment management, corporates can focus more on core operations like product development, customer acquisition, and strategic expansion instead of chasing receivables.

Key Benefits to Distributors

Distribution finance isn’t just a win for corporates—it delivers powerful advantages for distributors, dealers, and retailers as well:

- Access to Ready Working Capital: Distribution finance gives distributors immediate access to credit without the need for collateral or long approval cycles. This ensures they can purchase inventory as needed without waiting for customer payments or draining their internal resources.

- Higher Inventory Levels: With financing in place, distributors can maintain larger inventories, meet customer demand quickly, and capitalize on seasonal or market-driven sales opportunities—without worrying about cash constraints.

- Better Negotiation Power: Stronger purchasing ability allows distributors to negotiate better terms with suppliers, access bulk discounts, and optimize their procurement strategies, improving overall profitability.

- Business Growth Without Overleveraging: Unlike traditional loans that increase debt burdens, distribution finance is typically tied to actual business transactions. Distributors can scale operations sustainably, using credit as a growth enabler rather than a financial liability.

- Flexible Repayment Options: Many distribution finance programs offer repayment cycles that align with actual sales timelines. This flexibility reduces financial pressure and enables distributors to manage cash flows more effectively.

- Improved Credit Profiles: Consistent and timely repayment under a distribution finance program can help distributors build stronger credit histories, making it easier to access additional financing or expand business operations in the future.

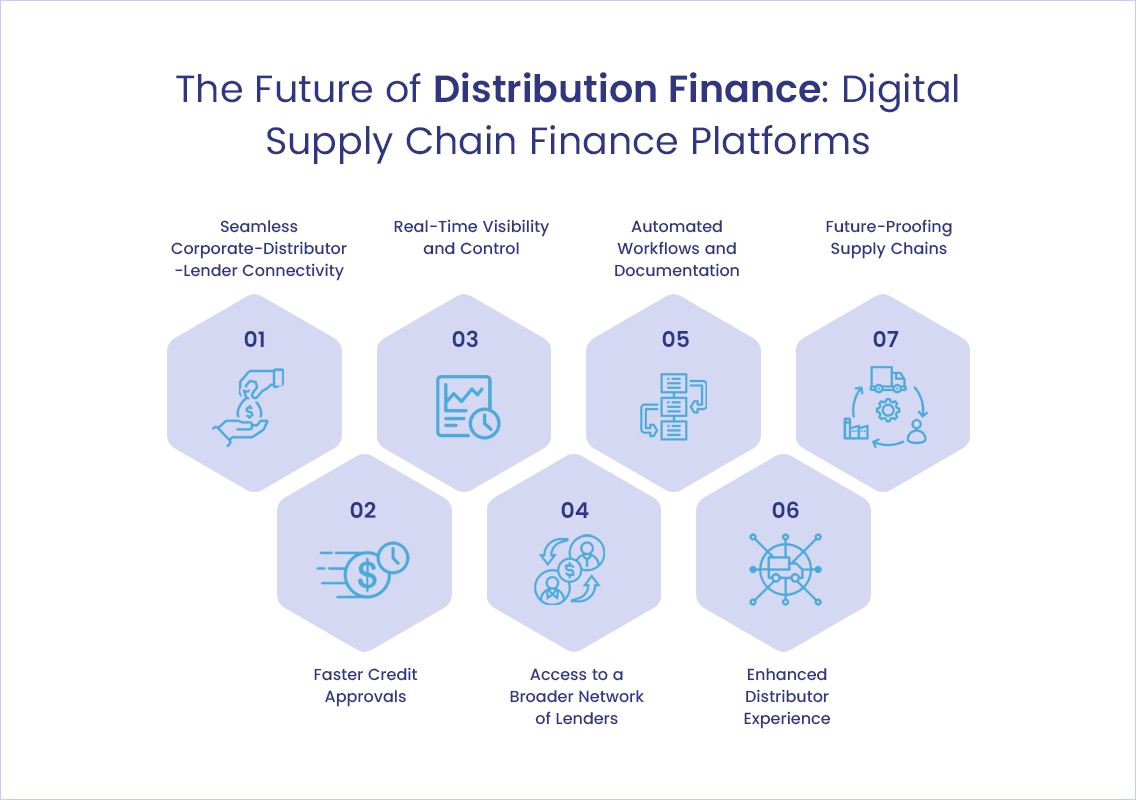

The Future of Distribution Finance: Digital Supply Chain Finance Platforms

Distribution finance is entering a new era—driven by the rise of digital supply chain finance platforms. As businesses seek faster access to capital, better visibility across their distribution networks, and stronger cash flow management, traditional manual processes are no longer enough. SCF platforms integrate corporates, distributors, and lenders into a single ecosystem, delivering faster access to capital, improved transparency, and greater operational control.

- Seamless Corporate-Distributor-Lender Connectivity: Purchase orders, invoicing, financing requests, approvals, and repayments can be managed in real time on a single integrated platform, eliminating manual back-and-forth and reducing delays.

- Faster Credit Approvals: Instead of waiting days or weeks for loan approvals, distributors can access financing almost instantly. Platforms use real-time data on distributor performance, payment history, and inventory turnover to streamline credit assessment and decision-making.

- Real-Time Visibility and Control: Corporates gain complete visibility into distributor credit utilization, outstanding payments, inventory movement, and financing activities. This helps them manage channel performance proactively, optimize inventory planning, and reduce supply chain risks.

- Access to a Broader Network of Lenders: Many digital SCF platforms operate on a multi-lender model, giving distributors access to a wide network of banks, NBFCs, and financial institutions. This fosters competitive financing terms and ensures that liquidity is always available when needed.

- Automated Workflows and Documentation: Digital platforms automate repetitive tasks like invoice validation, disbursement tracking, and repayment monitoring. This reduces operational overhead, minimizes errors, and frees up resources for more strategic business activities.

- Enhanced Distributor Experience: By simplifying financing access and offering flexible repayment options, digital SCF platforms empower distributors to grow faster and manage working capital more efficiently. A better financing experience leads to stronger, longer-lasting partnerships between corporates and their distribution channels.

- Future-Proofing Supply Chains: Technology-driven distribution finance strengthens supply chains by ensuring that liquidity flows stay uninterrupted—even during market volatility or demand surges. Corporates and distributors can plan growth initiatives with greater confidence, knowing that financing support is digitally enabled and scalable.

Conclusion: Unlock the Full Potential of Your Distribution Network

Distribution finance today is much more than bridging working capital gaps—it’s about building a smarter, faster, and more resilient distribution ecosystem. By empowering distributors with flexible financing and helping corporates enhance channel efficiency, it drives tangible growth across the entire supply chain.

As supply chains become more complex and customer expectations continue to rise, embracing digital supply chain finance platforms has become essential. These platforms enable businesses to unlock liquidity more efficiently, strengthen distributor relationships, and build supply chains that are more transparent, agile, and future-ready. Companies that invest in more innovative, integrated financing solutions today will be better positioned to scale sustainably and manage risks proactively.

Loan Frame offers comprehensive, tailored supply chain finance solutions, powered by a multi-lender network of leading Indian banks and NBFCs. Our platform helps corporates connect with reliable financing partners, extend payment terms to dealers and distributors, optimize working capital, and ensure smooth, timely cash flows across their distribution networks.

Book a demo to see how Loan Frame can power your distribution network with smarter, technology-driven financing.