July 31, 2025

Channel Finance in India

When a distributor delays an order, it’s rarely because they don’t need the goods. More often, it’s because their money is still tied up elsewhere – in customer payments that haven’t come in, in inventory that hasn’t moved fast enough, or in credit terms that leave little room to manoeuvre.

The effects don’t stop at the partner level. When liquidity stalls at the edge of the network, it slows everything upstream: order volumes dip, regional coverage becomes uneven, and planning cycles lose precision.

Channel Finance in India links short-term credit to trade transactions between manufacturers and their channel partners, making it easier for distributors to access working capital when. Instead of relying on informal arrangements or stretching payment terms, businesses utilize channel finance to introduce more structure and predictability to the flow of liquidity throughout the supply chain. The concept itself isn’t new, but the way these programs are being designed, delivered, and governed is steadily changing.

In this guide, we’ll take a closer look at how channel finance in India works, what roles different stakeholders play in a typical program, and how newer systems and platforms are improving execution across the board.

What Is Channel Finance?

Channel finance is a structured credit arrangement that enables dealers and distributors to access short-term working capital tied to their transactions with a corporate, often referred to as the “anchor.” Rather than relying on unsecured loans or informal credit, channel finance allows a business to secure funding based on confirmed purchases or approved invoices within a defined distribution relationship.

At its core, the model is simple: a corporate sells goods to a distributor, and a lender steps in to finance the distributor’s payment obligation. The distributor benefits from extended credit without needing to negotiate terms directly with the corporate, while the corporate receives timely payment without stretching its own balance sheet. The lender, in turn, gains confidence from the visibility and validation provided by the anchor.

Channel finance is distinct from traditional trade credit or term loans in that it is tightly linked to business activity. It is typically recurring, short-term, and designed to match the cash flow cycle of the channel partner.

Stakeholders

A typical channel finance program involves three core participants:

1. Anchor (Corporate or Manufacturer)

The anchor is the central business entity selling goods to multiple distributors or dealers. It establishes the commercial relationship, validates transactions, and often collaborates with lenders or platforms to structure a financing program for its channel partners.

While the anchor doesn’t lend directly, its involvement reduces risk for other participants. By confirming transactions and payment terms, it provides a level of assurance that allows lenders to extend credit more confidently.

2. Dealer or Distributor (Channel Partner)

This is the business entity purchasing goods from the anchor for resale. The distributor often needs working capital to fund purchases before receiving payments from their own customers. Channel finance allows them to access structured credit without requiring collateral or lengthy loan applications.

For these partners, the financing is typically embedded into their day-to-day operations, aligned with invoice cycles, repayment schedules, and inventory turnover.

3. Lender (Bank, NBFC, or Fintech)

The lender provides the actual financing. Based on transaction data, anchor validation, and risk assessment, it disburses short-term credit to the channel partner, often within defined limits and against pre-approved invoices.

In many cases, lenders work through platforms or directly with anchors to manage disbursement, repayment, and monitoring. The presence of a credible anchor improves risk visibility and can help lower the cost of credit.

Benefits of Channel Finance

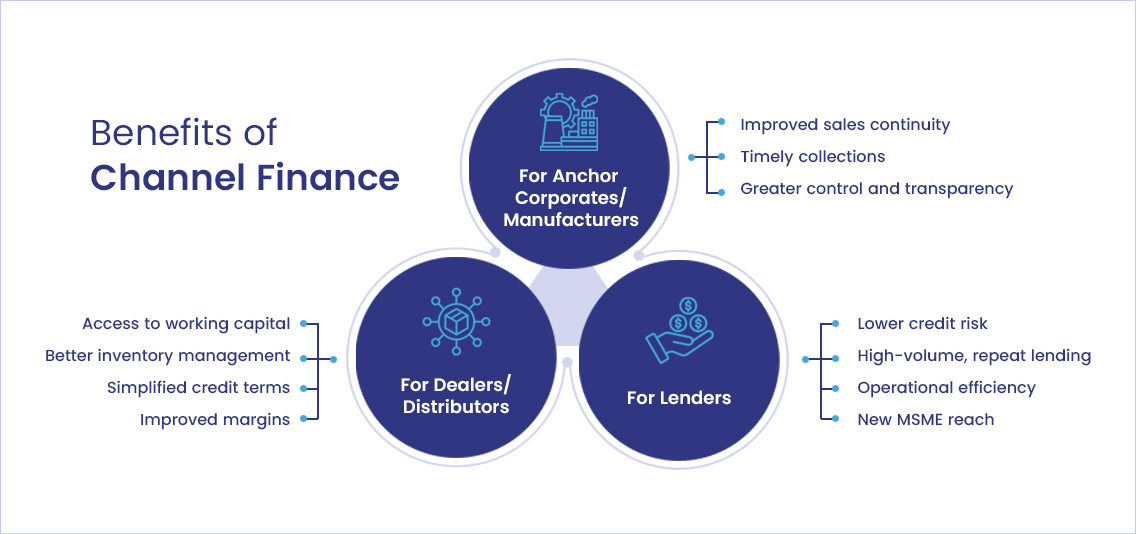

For Anchor Corporates / Manufacturers

- Improved sales continuity: Distributors are better equipped to place larger or more frequent orders, even during periods of tight cash flow.

- Timely collections: Anchors receive payments on time, reducing reliance on internal credit or overdue receivables.

- Stronger partner relationships: By enabling access to credit, corporates strengthen loyalty and expand their reach, especially in price-sensitive or underserved regions.

- Greater control and transparency: Digital programs offer better visibility into distributor exposure and repayment status, supporting more proactive risk management.

For Dealers / Distributors

- Access to working capital: Funding is tied to actual purchases, not long-term creditworthiness or collateral, making it more accessible, especially for MSMEs.

- Better inventory management: Distributors can restock on time, handle larger volumes, and respond more quickly to demand without overextending their balance sheets.

- Simplified credit terms: Financing terms are often more transparent and predictable than informal credit or negotiated payment extensions.

- Improved margins: Timely purchases can enable distributors to capitalize on bulk pricing or time-sensitive opportunities.

For Lenders

- Lower credit risk: Exposure is backed by validated transactions and the credibility of the anchor, reducing uncertainty.

- High-volume, repeat lending: Channel finance is tied to recurring business activity, allowing lenders to build stable, short-term loan books.

- Operational efficiency: Integration with platforms or anchor systems improves disbursement, monitoring, and collections.

- New MSME reach: Lenders can serve smaller or previously unbanked distributors by leveraging the anchor relationship for risk assessment.

How It Works – A Step-by-Step View

While specific implementations may vary, most channel finance programs follow a similar operational flow:

- Order and Invoice Generation: A distributor places an order with the anchor (manufacturer or corporate). Once goods are dispatched, the anchor issues an invoice and shares the transaction details with the finance partner, either directly or through an integrated platform.

- Invoice Validation and Credit Availability: The lender reviews the invoice, validates it against pre-agreed criteria, and checks if the distributor has available credit within their approved limit. This process may be automated, especially in platform-led programs.

- Disbursement of Funds: The lender disburses the invoice amount either to the anchor (on behalf of the distributor) or directly to the distributor, depending on the arrangement. The anchor receives payment upfront, while the distributor gains extended credit.

- Repayment by the Distributor: The distributor repays the lender on or before the agreed due date. Tenures are typically short, ranging from 30 to 90 days, and often aligned with the distributor’s inventory turnover or customer payment cycles.

- Monitoring and Reconciliation: Throughout the process, the lender and anchor track disbursements, repayments, and overdue amounts, ensuring visibility and governance. Many programs include automated alerts or escalation mechanisms for better control.

Challenges in Traditional Channel Finance Programs

While channel finance addresses a clear working capital gap, many programs struggle with execution. These challenges limit scalability, increase risk, and reduce the value for all stakeholders involved.

1. Manual Processes and Delays: Disbursement and repayment cycles often depend on paperwork, physical invoice validation, or delayed confirmations from the anchor. This slows down credit availability and creates unnecessary friction for distributors.

2. Lack of Visibility and Control: For anchors, tracking which distributor has borrowed what amount, when repayments are due, or how exposure is evolving across regions can be difficult without integrated systems. This makes it harder to manage risk or intervene early.

3. Limited Access for Smaller Partners: MSME distributors often face hurdles in accessing channel finance due to rigid documentation requirements, collateral demands, or a lack of historical credit data. Many are forced to rely on informal lenders or negotiate unfavourable payment terms.

4. One-to-One Lender Dependencies: Programs tied to a single lender may suffer from slow approvals, capacity constraints, or limited coverage. This reduces flexibility for both the anchor and its partners, especially when transaction volumes fluctuate.

5. Poor Reconciliation and Reporting: Without automated matching between invoices, disbursements, and repayments, anchors and lenders spend a significant amount of time reconciling data. Errors in this process increase compliance risks and operational workload.

Role of Fintech Platforms in Channel Finance

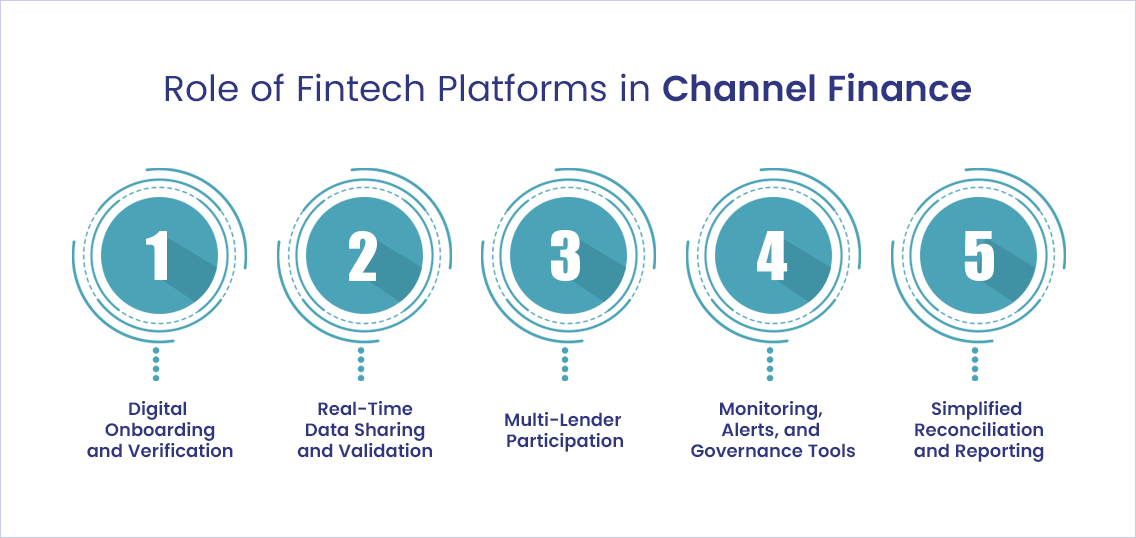

Fintech platforms are playing a critical role in making channel finance more accessible, scalable, and accountable, especially for corporates managing large or complex distribution networks.

1. Digital Onboarding and Verification: Platforms enable faster onboarding of distributors through integrations with KYC, GST, and bureau databases. What used to take days or remain entirely offline can now be completed in hours with structured digital workflows.

2. Real-Time Data Sharing and Validation: Invoices and purchase data can be shared instantly between the anchor, lender, and distributor. This reduces delays, removes the need for repeated confirmations, and ensures credit decisions are based on the most current information.

3. Multi-Lender Participation: Unlike legacy setups that tie a program to a single financier, many fintech platforms are built to support multiple lending partners. This provides anchors with greater flexibility and enables distributors to access the most suitable credit terms.

4. Monitoring, Alerts, and Governance Tools: With built-in dashboards and real-time status tracking, anchors and lenders can monitor disbursements, repayments, and exposures across the entire channel. Automated alerts flag potential issues early, improving governance and reducing risk.

5. Simplified Reconciliation and Reporting: Transaction-level visibility, audit trails, and digital documentation facilitate easier account reconciliation, dispute management, and compliance with internal and regulatory requirements.

Conclusion

A well-structured channel finance program aligns liquidity with business momentum. When distributors and dealers aren’t held back by rigid credit terms or manual processes, they’re able to order more, move faster, and stay closely aligned with the corporate’s growth trajectory. For anchors, this results in better throughput, stronger partner relationships, and improved visibility across the distribution network.

However, effective execution remains a challenge. Many programs still depend on static credit lines, fragmented lender relationships, and time-consuming coordination. Loan Frame solves for these with a multi-lender supply chain finance platform tailored to the needs of Indian corporates. It brings together access to top Indian banks & NBFCs, digitised workflows, and intelligent borrower-lender matching into one unified system. Corporates can structure channel finance with greater precision, manage programs across regions through a single interface, and reduce manual effort. The platform is scalable, configurable, and backed by expert advisory to help you optimise adoption and impact.

Book a call to explore our channel finance solutions for your business.