Cash flow is the lifeblood of every business. Without steady inflows, even the most profitable companies can struggle to cover daily expenses, invest in new opportunities, or sustain long-term growth. Delayed payments and extended receivable cycles often create difficult cash gaps, and sometimes costly to bridge. Sales Invoice Discounting (SID) offers a practical and efficient way to solve this challenge. By leveraging outstanding invoices to access immediate funds, businesses can unlock working capital without waiting for customer payments or taking on additional debt. It’s a flexible financing solution that strengthens liquidity and supports faster, more confident decision-making.

In this guide, we’ll explore everything you need to know about Sales Invoice Discounting — from what it is and how it works to how it can help your business build a stronger financial foundation.

What is Sales Invoice Discounting?

Sales Invoice Discounting is a short-term financing solution that allows businesses to convert their outstanding customer invoices into immediate cash. Instead of waiting 30, 60, or even 90 days for buyers to settle their dues, companies can receive a significant portion of the invoice value upfront from a financier. Once the customer pays the invoice in full, the remaining balance — minus a small fee — is transferred to the business.

This approach helps companies maintain steady cash flow, meet operational expenses, and invest in growth initiatives — all without taking on additional loans or offering extra collateral.

Difference Between Sales Invoice Discounting and Factoring

While Sales Invoice Discounting and Factoring both help businesses access funds against unpaid invoices, they differ significantly in control and customer interaction:

| Aspect | Sales Invoice Discounting | Factoring |

| Control | The business retains full control over customer relationships and collections | The financier often manages collections directly from customers |

| Customer Notification | Typically confidential — customers are not informed. | Usually disclosed — customers are notified and pay the financier directly |

| Suitability | Ideal for businesses that want to maintain direct dealings with their customers. | Suitable for businesses that are comfortable outsourcing collections. |

| Cost | Generally lower fees compared to factoring. | It may be higher due to additional collection services. |

In short, Sales Invoice Discounting lets businesses unlock working capital without disrupting customer relationships, while Factoring may suit companies looking to outsource credit control and collections.

How Does Sales Invoice Discounting Work?

Here’s a step-by-step look at how the process typically works:

- Raise and Submit Invoices: After delivering goods or services to a customer, the business issues an invoice detailing the amount payable and the payment terms (e.g., 30, 60, or 90 days).

- Apply for Discounting: Instead of waiting for the payment term to end, the business submits the invoice to a financier (such as a bank, NBFC, or a digital lending platform) for discounting.

- Receive Immediate Funds: The financier verifies the authenticity of the invoice and advances a major portion of its value — usually around 80–90% — to the business within a short timeframe, often within 24 to 48 hours.

- Customer Makes Payment: On the due date, the customer pays the full invoice amount as per the original payment terms. Depending on the agreement, the payment may either go to the business or directly to the financier.

- Settlement of Balance: Once the customer payment is received, the financier releases the remaining balance (after deducting their agreed-upon fees and charges) to the business.

A Simple Example

Suppose a company issues an invoice of ₹10 lakh with 60-day payment terms. Through sales invoice discounting, it can immediately receive ₹8–9 lakh against the invoice instead of waiting two months. Once the customer settles the invoice, the financier deducts a small fee (say 2–3%) and transfers the remaining amount to the business.

This process allows businesses to bridge working capital gaps, meet expenses on time, and invest confidently — without adding debt to their balance sheets.

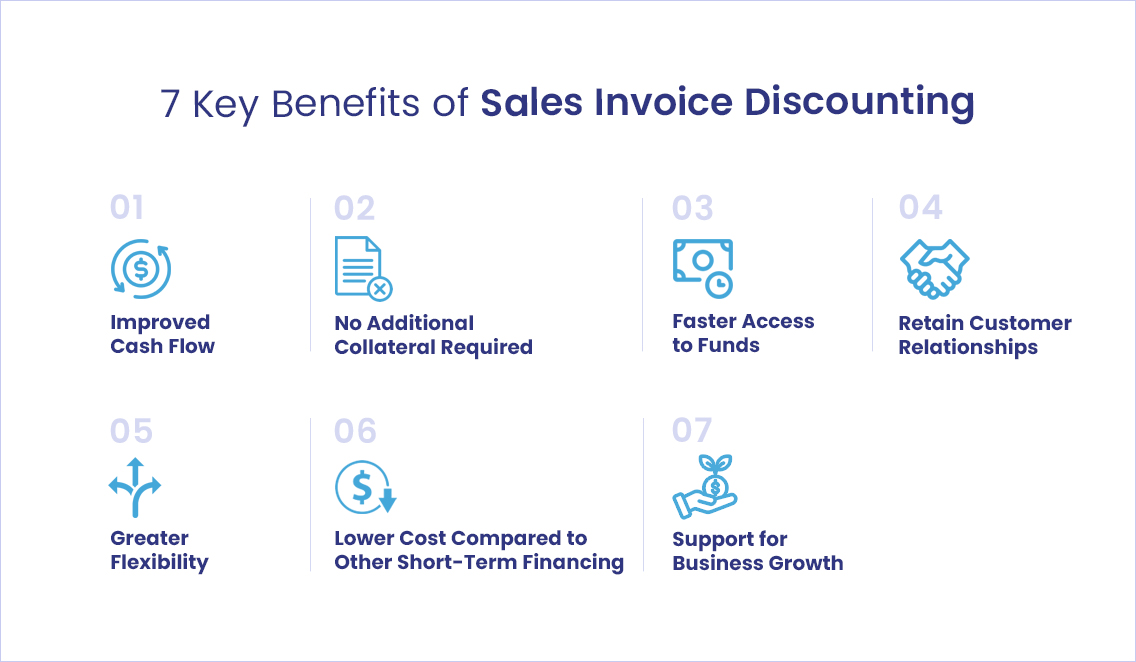

Key Benefits of Sales Invoice Discounting

- Improved Cash Flow: By converting unpaid invoices into immediate cash, businesses can maintain a steady flow of working capital. This helps cover day-to-day expenses, manage payroll, and invest in growth opportunities without waiting for customers to clear their dues.

- No Additional Collateral Required: Unlike traditional loans, sales invoice discounting is secured against the invoices themselves. Businesses don’t need to pledge additional assets or offer property as collateral, making it a more accessible financing option.

- Retain Customer Relationships: In most cases, invoice discounting remains confidential. Customers continue to make payments to the business as usual, ensuring that trust and direct relationships with clients are preserved.

- Greater Flexibility: Sales Invoice Discounting is typically a flexible, on-demand facility. Businesses can choose which invoices to discount and when, based on their cash flow needs, without being tied into long-term commitments.

- Lower Cost Compared to Other Short-Term Financing

Since the facility is secured against receivables, the cost of sales invoice discounting is often lower than unsecured loans, credit cards, or overdraft facilities — making it a cost-effective way to manage liquidity. - Support for Business Growth: By ensuring steady access to working capital, businesses can take on larger orders, negotiate better supplier terms, invest in expansion, and strengthen their market position without being held back by slow-paying customers.

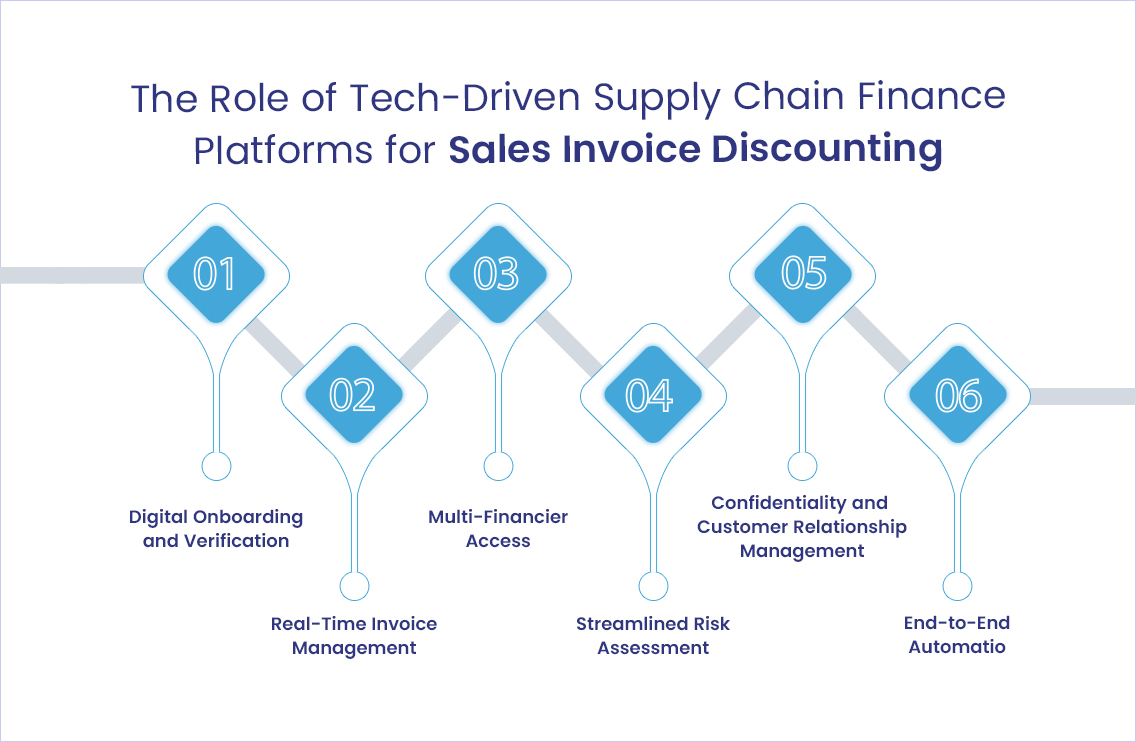

The Role of Tech-Driven Supply Chain Finance Platforms for Sales Invoice Discounting

While traditional sales invoice discounting involved a lot of manual processes — paperwork, bank visits, and lengthy verifications — modern technology-led Supply Chain Finance platforms have completely transformed the landscape.

Today, tech-enabled SCF platforms act as centralized hubs that seamlessly connect all key stakeholders: businesses (sellers), financiers (banks and NBFCs), and buyers (customers). Here’s how they enhance and streamline the sales invoice discounting process:

- Digital Onboarding and Verification: SCF platforms simplify onboarding with fully digital processes, minimizing paperwork and speeding up the verification of business credentials, invoices, and buyer relationships.

- Real-Time Invoice Management: Businesses can upload invoices, track approvals, and monitor financing status in real-time through an integrated platform. This transparency improves operational efficiency and ensures faster turnaround times for disbursements.

- Multi-Financier Access: Rather than depending on a single lender, businesses can access a network of banks and financial institutions through a single platform. This competitive environment often results in better financing terms, quicker approvals, and greater flexibility.

- Streamlined Risk Assessment: Advanced SCF platforms use data analytics, invoice verification technologies, and buyer credit profiling to assess risks quickly and accurately — reducing the chances of fraud and ensuring healthier financing portfolios.

- Confidentiality and Customer Relationship Management: Modern SCF platforms are designed to maintain confidentiality if needed, ensuring that customer relationships remain unaffected during the discounting process.

- End-to-End Automation: From invoice submission to financing, repayment tracking, and settlement, tech platforms automate the entire lifecycle — reducing manual errors, administrative overhead, and processing time.

In short, tech-enabled SCF platforms make sales invoice discounting more accessible, faster, and smarter — empowering businesses to unlock working capital without the traditional delays and complexities.

Who Can Benefit from Sales Invoice Discounting?

- Large Corporates with Extended Payment Cycles

Corporates across various industries, selling to large buyers like institutions or government entities, often face long receivable cycles. While payments are secure, the waiting period can strain working capital. Sales Invoice Discounting helps these businesses:

- Neutralize the working capital impact of 60–90–120-day payment terms

- Plan operations and investments based on predictable cash inflows

- Reduce the operational stress caused by delayed payments

- MSMEs Seeking Fast, Flexible Financing

MSMEs, regardless of their industry, frequently face challenges accessing traditional credit, despite strong sales growth. Sales Invoice Discounting offers them a scalable funding solution that grows with their business, without the need for heavy collateral or complex loan approvals. It empowers MSMEs to:

- Reinforce cash flow during expansion phases

- Accept larger customer orders without funding delays

- Build resilience without increasing long-term liabilities

Conclusion: Strengthen Your Cash Flow with Sales Invoice Discounting

Maintaining healthy cash flow has become more critical as businesses navigate long receivable cycles and rising operational demands. Sales Invoice Discounting provides a powerful, flexible way to unlock funds tied up in unpaid invoices — helping companies stay liquid, invest in growth, and operate with greater confidence.

Today, digital platforms are making invoice discounting faster, more seamless, and more accessible — enabling companies to turn receivables into immediate working capital without taking on additional debt.

At Loan Frame, we help businesses accelerate their cash flow with our Sales Invoice Discounting solution — offering up to 180 days of discounting, quick digital onboarding, real-time MIS, and same-day disbursals. Our lending partners review invoices and offer upfront capital based on the invoice value — with businesses receiving the full invoice amount, not just a percentage. Our platform connects businesses with a network of top financiers, ensuring the best rates and customized liquidity solutions tailored to your needs.

Connect with us today to discover how Loan Frame’s Sales Invoice Discounting solution can help you unlock faster cash flow and growth.