June 27, 2025

For many Indian businesses, especially those in manufacturing, distribution, and retail, managing cash flow across the supply chain is a daily challenge. Suppliers often face long payment cycles, while buyers must balance working capital needs with inventory and procurement demands. This imbalance creates a cash flow gap that can disrupt operations and strain business relationships.

Supplier and vendor financing offers targeted solutions to bridge this gap. These solutions enable buyers to extend payment terms without impacting supplier liquidity and allow suppliers to access payments faster—often at more favorable rates than traditional credit options. By improving cash flow visibility and reducing financial stress across the supply chain, they help businesses operate more smoothly and scale sustainably.

This blog explores what supplier and vendor financing is, how it works, and how technology-led platforms make it more efficient, transparent, and scalable.

What is Supplier and Vendor Financing?

Supplier and vendor financing refers to structured financial solutions that improve cash flow across a company’s supply chain by enabling early payments to suppliers and extending working capital support to vendors.

Typically initiated by a large corporate (the anchor), these solutions are designed to strengthen supplier relationships, ease vendor procurement, and optimize working capital for all parties — without requiring the anchor to strain its own cash flows.

Supplier financing ensures that suppliers receive faster payments against approved invoices through a financier, while vendor financing helps vendors access funding to purchase fulfill large orders based on their relationship with the anchor corporate.

Together, supplier and vendor financing help build a more resilient, efficient, and liquidity-rich supply chain ecosystem.

How Supplier and Vendor Financing Works

Supplier and vendor financing usually operates under an anchor-led model in the following way:

Supplier Financing Flow:

- The corporate buyer approves the supplier’s invoice.

- A financier (bank, NBFC, or SCF platform) pays the supplier early, at a discounted rate.

- The corporate repays the financier later, on the original invoice due date.

Vendor Financing Flow:

- Vendors receive working capital financing from financiers based on purchase orders, invoices, or sales agreements with the corporate.

- They repay the financier in installments or as per agreed repayment schedules.

In both models, financing is linked to real supply chain transactions, and the anchor’s credit profile plays a key role in enabling better access to affordable financing for their suppliers and vendors.

Types of Supplier and Vendor Financing in India

In India, several financing models are used to support supply chain participants:

- Reverse Factoring (Approved Payables Finance): Suppliers receive early payments through a financier after corporate approval, with repayment from the corporate on maturity.

- Factoring: Suppliers sell their outstanding receivables to financiers for upfront cash, with the financier collecting payments from the buyer.

- Invoice Discounting: Suppliers individually discount their invoices with financiers to unlock cash flow without requiring formal buyer involvement.

- Vendor Pay-Later/Structured Payment Models: Vendors can defer payments for goods purchased and repay over flexible terms, making it easier to scale their operations.

Key Benefits of Supplier and Vendor Financing

Supplier and vendor financing solutions are designed to strengthen both sides of the supply chain—buyers as well as suppliers and vendors. Here’s how each group benefits:

For Buyers

- Improved Cash Flow Management: Buyers can extend their payment cycles without negatively impacting supplier relationships, allowing them to optimize working capital and better manage liquidity.

- Stronger Supplier Relationships: Offering early payment options or access to financing builds goodwill, strengthens supplier loyalty, and ensures a more reliable and resilient supply chain.

- Negotiation Leverage: Buyers who enable supplier financing often gain stronger negotiation power, whether for better pricing, higher service levels, or preferred terms.

- Reduced Supply Chain Risks: Financially stable suppliers are less likely to face disruptions, helping buyers maintain consistency in procurement and production schedules.

For Suppliers and Vendors

- Faster Access to Cash: Suppliers and vendors can convert approved invoices into immediate working capital, avoiding long payment delays and reducing dependency on expensive loans or overdraft facilities.

- Lower Financing Costs: Supplier financing programs often provide access to lower-cost funding because the risk is based on the buyer’s credit rating rather than the supplier’s own financial strength.

- Better Working Capital Cycles: Immediate access to receivables improves cash flow, allowing suppliers and vendors to reinvest in operations, raw materials, inventory, or business expansion.

- Competitive Advantage: Suppliers and vendors who offer or facilitate financing can differentiate themselves in a crowded marketplace by making procurement easier for their buyers.

Challenges in Supplier and Vendor Financing

- Complex Onboarding and Documentation

Setting up financing programs typically involves extensive paperwork, regulatory compliance, credit checks, and KYC processes for multiple stakeholders. This can slow down onboarding, especially for MSMEs or suppliers with limited formal systems. - Lack of Visibility and Transparency

In traditional models, buyers, suppliers, and financiers often operate in silos with fragmented data. Financing operations can become inefficient and prone to errors or disputes without real-time visibility into invoices, payment statuses, and approvals. - Managing Costs

Financing comes at a cost—whether through discount rates, service fees, or interest charges. Buyers and suppliers must carefully manage these costs to ensure that financing solutions support growth rather than erode margins. - Ensuring Timely Repayments

Buyers using vendor financing or suppliers participating in supplier finance programs must adhere to repayment schedules. Delays or defaults can strain supplier relationships, affect creditworthiness, and increase risk for financiers. - Credit Risk and Dependency

Vendors may hesitate to extend credit if buyers’ financial profiles are weak. Similarly, financiers in supplier finance programs require accurate risk assessments to prevent exposure to potential defaults. - Operational and Process Inefficiencies

Manual invoice processing, physical documentation, and offline reconciliations create delays and increase the chances of human errors. These inefficiencies can cause payment bottlenecks, disrupt cash flows, and limit scalability. - Limited Access for MSMEs

Many traditional supplier and vendor financing models prioritize large corporates and Tier 1 suppliers. MSMEs—who often face the greatest cash flow constraints—may find it difficult to participate due to insufficient formal records or limited credit histories.

The Role of Technology in Supplier and Vendor Financing

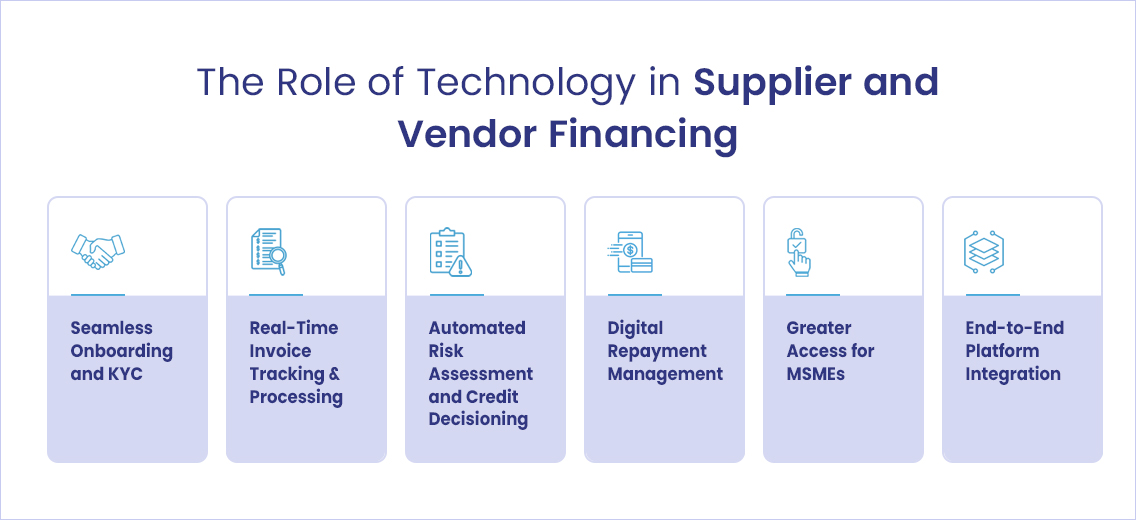

Technology is transforming supplier and vendor financing by addressing traditional challenges of inefficiency, lack of transparency, high costs, and limited access. Digital platforms, automation tools, and data-driven risk models enable businesses—both large corporates and MSMEs—to manage working capital more efficiently across the supply chain.

Here’s how technology is reshaping supplier and vendor financing in India:

- Seamless Onboarding and KYC: Digital SCF platforms automate onboarding, including eKYC, documentation collection, and verification processes, enabling faster scale-up.

- Real-Time Invoice Tracking and Processing: Integrated systems provide real-time updates on invoice status, approvals, and payments, improving trust and accelerating financing cycles.

- Automated Risk Assessment and Credit Decisioning: Platforms leverage GST data, transaction histories, and payment behaviors for dynamic credit risk assessments, expanding access to financing for MSMEs.

- Digital Repayment Management: Automated payment alerts, tracking systems, and ERP integrations make repayments timely, reducing the risk of defaults.

- Greater Access for MSMEs: Advanced digital SCF marketplace platforms democratize access, offering MSMEs better financing opportunities without excessive paperwork.

- End-to-End Platform Integration: Integration with ERP, accounting, and inventory systems streamlines financing workflows, from purchase orders to payment reconciliation.

Conclusion

Supplier and vendor financing are critical strategies for businesses looking to strengthen supply chain resilience, manage cash flows more efficiently, and build long-term supplier partnerships. However, despite their potential, many companies still face challenges such as complex onboarding, lack of visibility, managing financing costs, and ensuring timely repayments.

Technology plays a transformative role in overcoming these hurdles, making supply chain financing faster, more transparent, and more accessible, especially for Indian businesses working with diverse supplier and dealer networks.

At Loan Frame, we help businesses unlock the true value of supplier and vendor financing through a technology-led, multi-lender platform. Our solution enables you to optimize working capital, offer suppliers early payments, negotiate better terms, and maintain seamless operations—with full ERP integration and real-time visibility into supplier transactions and performance.

Book a demo with Loan Frame to explore how we can support your growth.