For many Micro, Small, and Medium Enterprises (MSMEs), accessing capital is one of the biggest challenges to growth. In the absence of supply chain finance platforms, traditional loans often come with strict requirements like heavy collateral, long approval times, and high interest rates — making it hard for MSMEs to get the funding they need when they need it. Without easy access to capital, it becomes difficult for small businesses to expand, manage cash flow, and compete effectively.

Today, Supply Chain Finance platforms help MSMEs unlock capital faster and more easily by leveraging their business relationships with larger buyers. Instead of relying only on traditional banks, MSMEs can now access flexible financing linked directly to their invoices and receivables — often without needing heavy paperwork or assets as security.

In this blog, we’ll explore the challenges MSMEs face in accessing capital and how supply chain finance platforms are reshaping the way they fund their businesses.

What is Supply Chain Finance

Supply Chain Finance is a set of technology-driven financial solutions that help businesses manage their cash flow and working capital needs more efficiently. It enables suppliers to receive early payments for their goods or services while giving buyers more time to pay — creating a win-win for both sides. SCF is especially useful for MSMEs that often face cash flow gaps between paying suppliers and receiving payments from customers.

Key Stakeholders of Supply Chain Finance:

- Suppliers: Businesses that provide goods or services and extend credit to buyers. In an SCF model, they benefit from early payments without altering the buyer’s cash flow cycle.

- Buyers: MSMEs that purchase goods or services and seek flexible payment terms to better manage cash flow without straining supplier relationships.

- Financial Institutions: Banks, NBFCs, and fintech platforms that offer financing based on confirmed invoices, providing liquidity to suppliers while managing associated risks.

- Supply Chain Finance Platforms: Technology platforms that connect suppliers, buyers, and financiers. They automate processes such as invoice verification, payments, and disbursals, creating a seamless and efficient experience for all participants.

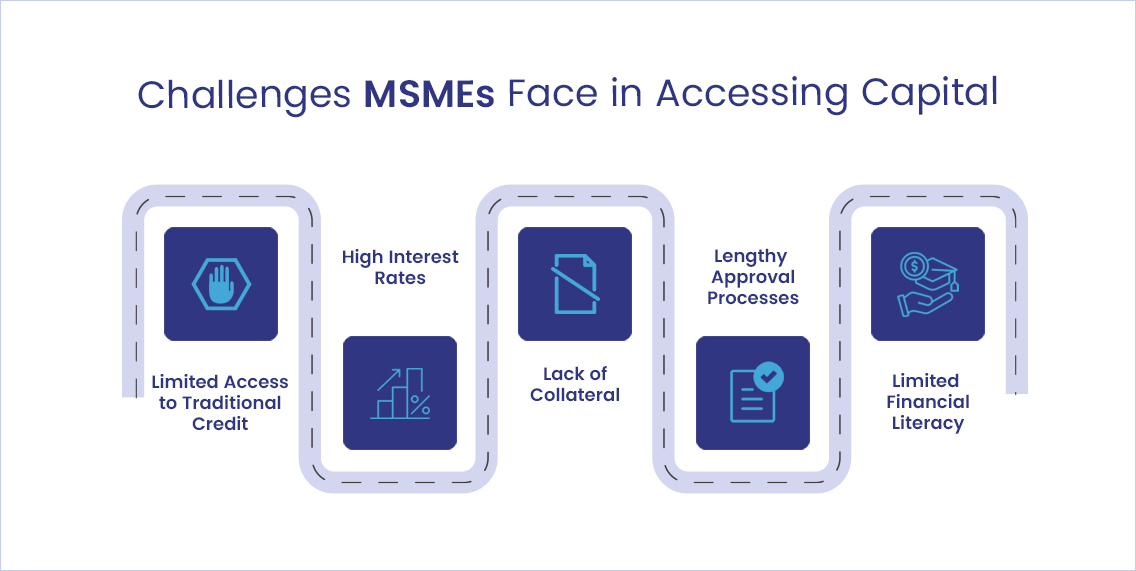

Challenges MSMEs Face in Accessing Capital

Access to capital is critical for MSMEs to manage day-to-day operations, invest in growth, and remain competitive. However, many MSMEs face persistent barriers when trying to secure funding through traditional channels, such as:

1. Limited Access to Traditional Credit: Many MSMEs lack formal credit histories or have thin financial documentation, making it difficult for banks and traditional lenders to assess their creditworthiness. As a result, many business loan applications are delayed or rejected.

2. High Interest Rates: Even when financing is available, it often comes at a high cost. MSMEs, especially smaller ones, are typically considered higher-risk borrowers and are charged higher interest rates, which can erode margins and discourage expansion.

3. Lack of Collateral: Traditional lenders usually require assets like property, machinery, or inventory to secure loans. Many MSMEs, particularly newer businesses, may not have sufficient collateral to meet these requirements.

4. Lengthy Approval Processes: Traditional loan approvals can take weeks or even months, involving extensive paperwork and multiple verification stages. For MSMEs needing quick access to working capital, such delays can disrupt operations.

5. Limited Financial Literacy: While MSME owners are often experts in their industries, they may have limited knowledge of complex financing options. This can make it difficult to secure the most suitable funding solutions or fully understand loan terms.

How Supply Chain Finance Platforms Are Helping Overcome These Barriers

With traditional financing often out of reach, supply chain finance platforms offer MSMEs a powerful alternative to access much-needed working capital. By leveraging technology and existing supply chain relationships, supply chain finance platforms make it faster, simpler, and more affordable for MSMEs to fund their operations and growth.

Here’s how supply chain finance platforms are helping MSMEs overcome key challenges:

1. Easier Access Without Heavy Collateral: SCF financing is based on the strength of the buyer-supplier relationship rather than just the MSME’s balance sheet. This enables businesses to secure funds without the burden of pledging significant assets.

2. Alternative Financing Models

supply chain finance platforms offer multiple flexible options:

- Invoice Financing: MSMEs can quickly leverage outstanding invoices to access funds, converting receivables into working capital.

- Reverse Factoring: Suppliers receive early payment from a financial institution, while MSMEs benefit from extended payment periods, improving liquidity for both parties.

3. Improved Cash Flow Management: By enabling faster payment cycles and unlocking tied-up cash, SCF platforms help MSMEs maintain healthier cash flow, manage expenses efficiently, and invest in growth initiatives with more confidence.

4. Faster Turnaround Times: Automated workflows on SCF platforms significantly reduce the time needed for invoice verification, approvals, and fund disbursal — often shrinking funding cycles from several weeks to just a few days.

5. Lower Cost of Capital: Because SCF financing often relies on the creditworthiness of larger buyers rather than solely the MSME’s financials, businesses can access more affordable financing rates than traditional unsecured loans.

6. Flexibility in Payment Terms: SCF platforms enable MSMEs to negotiate more favorable payment terms with their suppliers. This flexibility helps businesses align cash inflows and outflows better, reducing financial strain.

7. Faster Growth and Expansion: With quicker, easier access to working capital, MSMEs can invest in scaling production, expanding inventory, entering new markets, or taking on larger orders.

8. Streamlined, Tech-Enabled Processes: Digital SCF platforms simplify documentation, automate transactions, and provide real-time visibility into payment statuses, creating a seamless financing experience for MSMEs.

9. Stronger Supplier Relationships: Ensuring timely payments strengthens trust between MSMEs and their suppliers, allowing businesses to negotiate better terms and maintain smoother supply chain operations.

Conclusion: Enabling Better Credit Access for MSMEs with Supply Chain Finance Platforms

Supply Chain Finance platforms are reshaping how MSMEs access capital. By offering flexible, efficient, and collateral-light financing solutions, SCF platforms are helping small businesses overcome major funding challenges. They are not just solving short-term liquidity challenges but also enabling MSMEs to strengthen supplier relationships, manage cash flow more effectively, and invest confidently in growth.

At Loan Frame, we make it easier for MSMEs, distributors, and vendors to access working capital through our digital, multi-lender SCF platform. Our technology connects businesses with multiple financing options, offering extended credit periods, flexible terms, and competitive rates without heavy collateral. Designed to adapt to changing market demands and compliance requirements, our platform helps businesses manage cash flow, streamline procurement, and support day-to-day operations.

Contact us today to get the right working capital solution for your business.