March 14, 2025

Supply Chain Finance Platforms: How Indian Corporates Can Maximize Cash Flow Across Their Supply Chains

Cash flow is crucial for any business, yet many Indian corporates face challenges such as delayed payments, liquidity gaps, and inefficient financing options. Supply Chain Finance platforms offer a solution by streamlining cash flow and unlocking working capital. These platforms enable suppliers to access early payments, while buyers can extend payment terms, improving financial stability for both parties.

Supply Chain Finance provides working capital financing for both buyers and sellers—sellers can borrow against receivables, and suppliers can access third-party financing for approved invoices. Technology-driven Supply Chain Finance platforms simplify transactions, optimize working capital, ensure real-time liquidity, and reduce manual tasks, all of which support long-term growth. Advanced technologies such as AI and OCR reduce friction in processes such as onboarding and invoicing, helping integrate MSMEs into corporate supply chain finance networks.

For Indian corporates, leveraging these platforms enhances liquidity, strengthens supplier relationships, and boosts operational efficiency. By providing real-time data, automating processes, and ensuring transparency, Supply Chain Finance platforms empower corporates to optimize working capital and make informed decisions while staying ahead in a digital economy. This blog explores how these platforms transform credit access and foster growth for Indian corporates and MSMEs.

Supply Chain Finance Management – Key Challenges for Indian Corporates

Managing supply chain finance in India presents significant challenges for corporates, such as:

- Limited Real-Time Data:Effective decision-making in supply chain finance requires real-time financial data. However, many Indian corporates rely on manual, fragmented systems, causing delays in identifying cash flow gaps and managing financial risk. This lack of real-time insights limits the ability to make informed decisions.

- High Operational Costs: Manual transaction processing, account reconciliation, and communication increase time, errors, and resource needs, creating a significant barrier in India’s price-sensitive market.

- Regulatory and Compliance Challenges:Various state regulations across India complicate manual compliance, making consistent transaction and financial process adherence challenging without automation and transparency.

- Complex Credit Risk Management: Fragmented supply chains and outdated data make credit risk assessment difficult, increasing defaults, delayed payments, and missed opportunities, disrupting supply chains.

- Gaps in Regional Access: Limited platform access in rural areas and smaller cities creates an urban-rural adoption gap due to a lack of awareness and infrastructure.

- Lack of Industry Standardization:India’s supply chain finance ecosystem is fragmented, with various practices, processes, and documentation requirements across industries. The lack of industry-wide standardization results in inefficiencies, delays, and confusion, making it harder for businesses to adopt and scale these initiatives.

Supply Chain Finance Platforms – The Role of Next-Gen Technology

The shift from traditional, manual methods to technology-driven solutions is fundamental to the success of supply chain finance adoption. Digital supply chain finance platforms leverage fintech solutions to automate processes, improve data accessibility, and provide real-time financial insights. This allows corporates to make faster, more informed decisions and gives suppliers better access to liquidity.

These solutions streamline transactions among buyers, suppliers, and financial institutions, optimizing cash flow and extending payment terms while ensuring timely supplier payments without relying on traditional loans. Digital supply chain finance solutions replace manual paperwork, lengthy approvals, and physical documentation, reducing delays, errors, and strained supplier relationships. Automation and real-time payment tracking enhance speed, transparency, and efficiency, improving risk management and cash flow.

How Supply Chain Finance Platforms Benefit Corporates

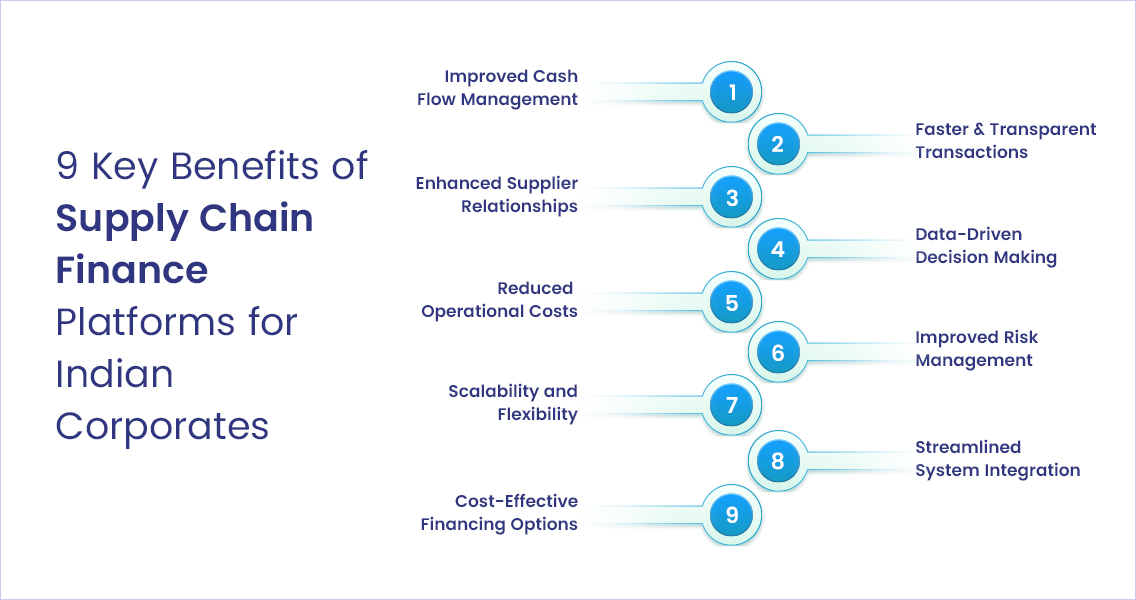

Supply chain finance platforms deliver the following benefits to corporates, particularly through leveraging advanced technologies:

- Improved Cash Flow Management: Supply chain finance platforms improve corporate cash flow through extended buyer payment terms while offering suppliers early payment options. Businesses can make more strategic decisions regarding cash allocation by automating payment processes and providing real-time visibility into cash flows. This flexibility allows corporates to manage their liquidity better, ensuring they have funds available for growth opportunities without straining supplier relationships.

- Faster and Transparent Transactions: By replacing slow, manual processes, supply chain finance platforms automate documentation and enable real-time payment tracking. This accelerates transactions, minimizes errors, and improves transparency, providing greater control over financial operations.

- Enhanced Supplier Relationships:Supply chain finance platforms empower suppliers with faster access to capital, improving their cash flow. Early payment options strengthen buyer-supplier relationships, fostering corporate trust and loyalty while building a more resilient and collaborative supply chain.

- Data-Driven Decision Making:Real-time data and advanced analytics provide up-to-date financial insights, allowing corporates to make better, informed financial decisions. Businesses can track payments, receivables, and cash flow, identify patterns, assess credit risk, and forecast needs.

- Reduced Operational Costs:Supply chain finance platforms streamline and automate manual processes, reducing the time and resources needed to manage transactions. Administrative costs come down by eliminating physical paperwork, reducing manual reconciliations, and automating payment processes. Additionally, with fewer errors and improved efficiency, corporates can focus more on strategic growth rather than day-to-day financial operations.

- Improved Risk Management:Platforms provide insights into supplier and buyer financial health, improving credit risk assessment. Real-time data enables proactive risk mitigation and optimized payment terms, ensuring stable cash flow and reduced defaults.

- Scalability and Flexibility:Supply chain finance platforms offer scalable solutions that are adaptable to evolving business needs. Whether expanding into new markets or managing larger supply chains, these solutions can easily handle increased transaction volumes and provide flexible payment terms.

- Streamlined System Integration:These platforms seamlessly integrate with existing ERP and financial management systems, ensuring smooth data flow, reducing manual entry, minimizing errors, and aligning financial processes with broader business strategies.

- Cost-Effective Financing Options:By leveraging supply chain finance platforms, Corporates can access competitive financing rates based on buyer creditworthiness, enabling suppliers to receive early payments at lower costs than traditional methods, improving profitability.

Conclusion: Envisioning Growth with Next-Gen Supply Chain Finance Platforms

For small and medium businesses, the difference between success and failure often comes down to getting paid on time. For larger companies, missing out on growth opportunities due to locked-up capital is a major issue. These examples of missed potential highlight the importance of maximizing financial value. As businesses grapple with evolving cash flow management and supply chain optimization challenges, adopting a next-gen supply chain finance platform is critical for staying competitive.

Digital supply chain finance solutions provide corporates with the means to improve operational agility, maintain liquidity, and preserve supplier partnerships. Through automation, real-time insights, and seamless integration, these platforms empower data-driven decisions and streamline operations, ensuring businesses remain future-proof.

Loan Frame offers comprehensive, tailored supply chain finance solutions, integrating a multi-lender network of top Indian banks and NBFCs to provide corporates with flexible and cost-effective financing. Our platform connects businesses with reliable financing options, helping them extend payment terms to suppliers, optimize working capital, and ensure timely payments.

Book a demo to see our supply chain finance platform in action.