July 22, 2025

In India, managing working capital is a balancing act between operational efficiency and financial resilience. For large corporates, it’s not just about having enough cash to cover day-to-day expenses—it’s about using that capital to drive growth, protect margins, and maintain a competitive edge. Yet, with long payment cycles, rising costs, and unpredictable market conditions, managing working capital effectively has become more complex than ever.

This guide breaks down the key components, metrics, and importance of working capital management for Indian corporates aiming to optimise cash flow.

What is Working Capital?

Working capital is the difference between a company’s assets and liabilities. It serves as a measure of a company’s operational efficiency and short-term financial health. Working capital represents the funds available to cover day-to-day business operations, such as paying suppliers, employees, and other operational expenses.

For corporates, maintaining sufficient working capital is essential for meeting short-term debts and seizing growth opportunities without disruption. A healthy working capital position ensures smooth operations, while poor management can lead to liquidity issues, impairing the company’s ability to meet its obligations.

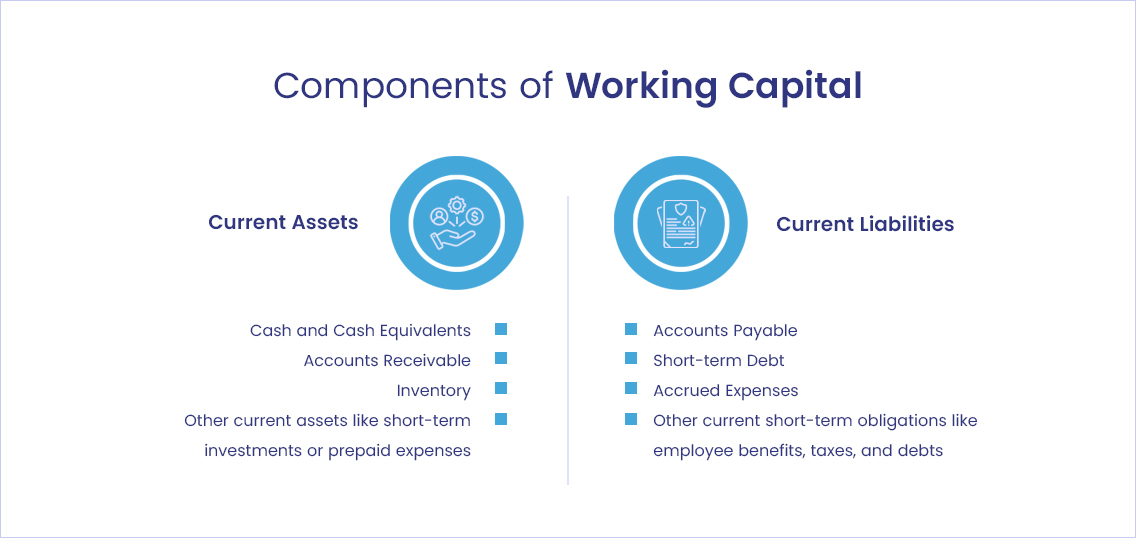

Components of Working Capital

Working capital is made up of various components that reflect how well a business is managing its short-term financial resources:

1. Current Assets

Current assets are the resources a company expects to convert into cash or use within a year:

- Cash and Cash Equivalents: Cash is the most liquid asset a company can hold and is used for everyday operations. Cash equivalents are short-term, highly liquid investments that can easily be converted into cash within 3 months, such as treasury bills or marketable securities.

- Accounts Receivable: Accounts receivable represents money owed to the business by customers who have purchased goods or services on credit.

- Inventory: Inventory refers to a company’s goods for sale or use in its operations. This includes raw materials, work-in-progress, and finished goods. Inventory management is a delicate balance: too much inventory ties up cash that could otherwise be used for operational needs, while too little could lead to stockouts and missed sales opportunities.

- Other Current Assets: These may include short-term investments, prepaid expenses (like insurance premiums), and any other assets expected to be converted into cash or consumed within one year.

2. Current Liabilities

Current liabilities are obligations that a company must settle within a year:

- Accounts Payable: Accounts payable is money the company owes to suppliers or vendors for goods or services received.

- Short-term Debt: Short-term debt includes loans or credit lines that must be repaid within the year. This might include bank loans, credit card balances, or lines of credit.

- Accrued Expenses: These are expenses that have been incurred but not yet paid. Common examples include wages, taxes, and utilities. Accrued expenses are liabilities that must be settled within a short period.

- Other Current Liabilities: This category includes various short-term obligations such as provisions for employee benefits, taxes due within the next year, and any other debts the company expects to settle shortly.

The Interplay Between Components

The relationship between current assets and current liabilities is crucial in determining the overall health of a company’s working capital. The goal is to ensure that the business can quickly convert its assets into cash to meet its liabilities. Companies that can effectively manage their components of working capital—by collecting receivables promptly, optimizing inventory turnover, and extending favorable payment terms—are better positioned to maintain liquidity, reduce financial stress, and invest in growth.

The formula for working capital is straightforward:

Working Capital = Current Assets – Current Liabilities

When a company has a positive working capital, it has more assets than liabilities due in the short term, which is a good sign of financial health. A negative working capital indicates that the company may struggle to meet its short-term obligations, which could cause financial distress or operational disruptions.

Key Metrics to Understand Working Capital Efficiency

Working Capital Ratio: This Ratio shows the ability of a company to cover its short-term liabilities with its short-term assets. The formula is:

Working Capital Ratio = Current Assets / Current Liabilities

A ratio between 1.5 to 2 is generally considered healthy. A ratio higher than 2 might indicate inefficient use of assets, while a ratio below 1 may suggest liquidity problems.

Current Ratio & Quick Ratio: These ratios are used to assess a company’s ability to meet short-term obligations. While similar, the Quick Ratio (also known as the acid-test Ratio) is a more stringent measure as it excludes inventory, which can sometimes be difficult to liquidate quickly.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Both ratios help investors, creditors, and managers gauge a company’s financial stability and ability to weather unexpected disruptions or cash flow shortages.

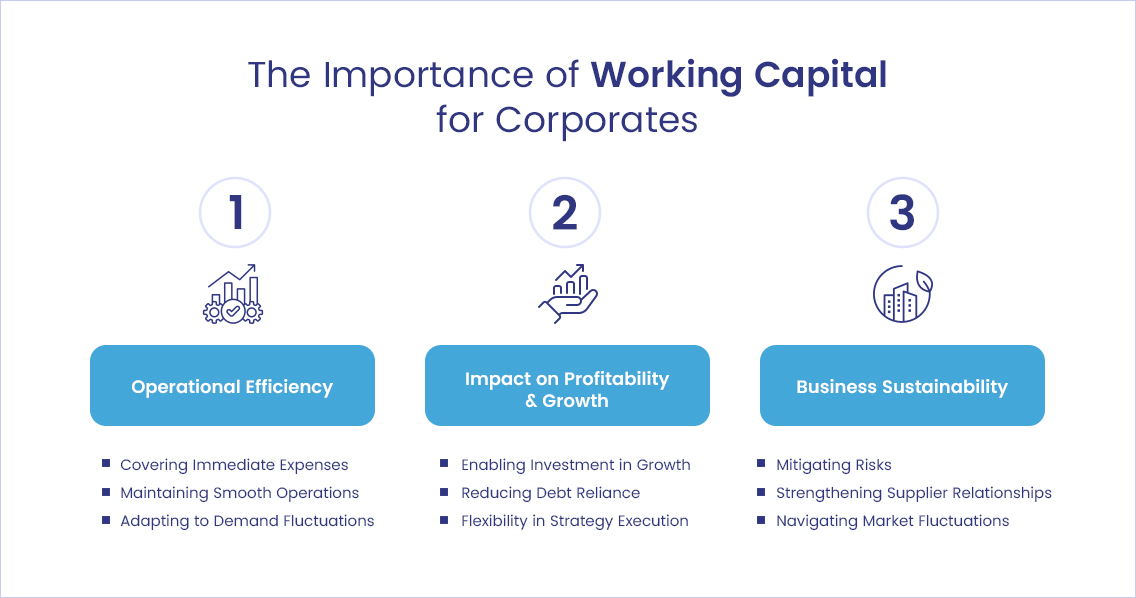

The Importance of Working Capital for Corporates

Working capital is not just a measure of a company’s short-term financial health; it is the foundation on which businesses build their operational efficiency, growth potential, and economic stability.

1. Operational Efficiency

Working capital ensures a business has the funds to cover its day-to-day needs. Without it, even profitable companies can face liquidity issues, struggling to pay suppliers or meet payroll. Key benefits include:

- Covering Immediate Expenses: It enables timely payment of short-term debts like accounts payable.

- Maintaining Smooth Operations: It ensures critical operational processes, such as purchasing materials and paying employees, continue without disruption.

- Adapting to Demand Fluctuations: It helps businesses respond to market changes without emergency financing.

2. Impact on Profitability & Growth

Beyond operations, working capital directly affects profitability and growth:

- Enabling Investment in Growth: It provides the resources to invest in expansion, whether through new products, markets, or increased capacity.

- Reducing Debt Reliance: Proper working capital management reduces dependence on costly short-term loans, improving profitability.

- Flexibility in Strategy Execution: It allows businesses to pivot quickly, responding to market trends and consumer demands without financial strain.

3. Business Sustainability

Financial sustainability is just as important as operational sustainability. Effective working capital management helps businesses navigate disruptions:

- Mitigating Risks: It provides a cushion during economic downturns, natural disasters, or supply chain disruptions, allowing businesses to continue operating without resorting to debt.

- Strengthening Supplier and Customer Relationships: Timely payments foster strong supplier relationships and better terms. It also enables businesses to offer flexible payment terms, increasing customer loyalty.

- Navigating Market Fluctuations: Working capital acts as a buffer during slow sales periods, allowing businesses to maintain operations and ride out market volatility.

Conclusion

Working capital is more than a liquidity buffer. It is a core enabler of agility, operational stability, and long-term competitiveness. Effective working capital management requires more than tracking ratios; it demands active coordination across receivables, payables, and inventory, ensuring each element contributes to a healthier cash position and stronger decision-making. Businesses that take a structured, data-led approach are better equipped to anticipate cash flow needs, handle market fluctuations, and fund strategic initiatives without disruption.

Loan Frame’s Supply Chain Finance platform connects corporates with a vast network of top Indian banks and NBFCs. Through a single digital interface, the platform streamlines the entire cycle from billing to collections, offers customisable financing structures, and provides expert advisory support.

Book a demo to explore how our SCF solutions can help you take control of your working capital.