Managing working capital is a complex reality for Indian corporates. Payment cycles can shift, supplier terms are rarely uniform, and market changes often call for quick decisions. Even as businesses expand, keeping funds flowing smoothly through every stage of operations remains a constant priority.

With these challenges in mind, more companies are exploring new ways to manage cash flow beyond the traditional playbook. Technology, in particular, is beginning to reshape what’s possible, making it easier to access financing, track transactions, and adapt quickly to shifting needs.

In this blog, we examine the key challenges Indian corporates face with working capital, highlight strategies that address them, and explore how digital supply chain finance platforms are helping businesses unlock working capital with greater efficiency.

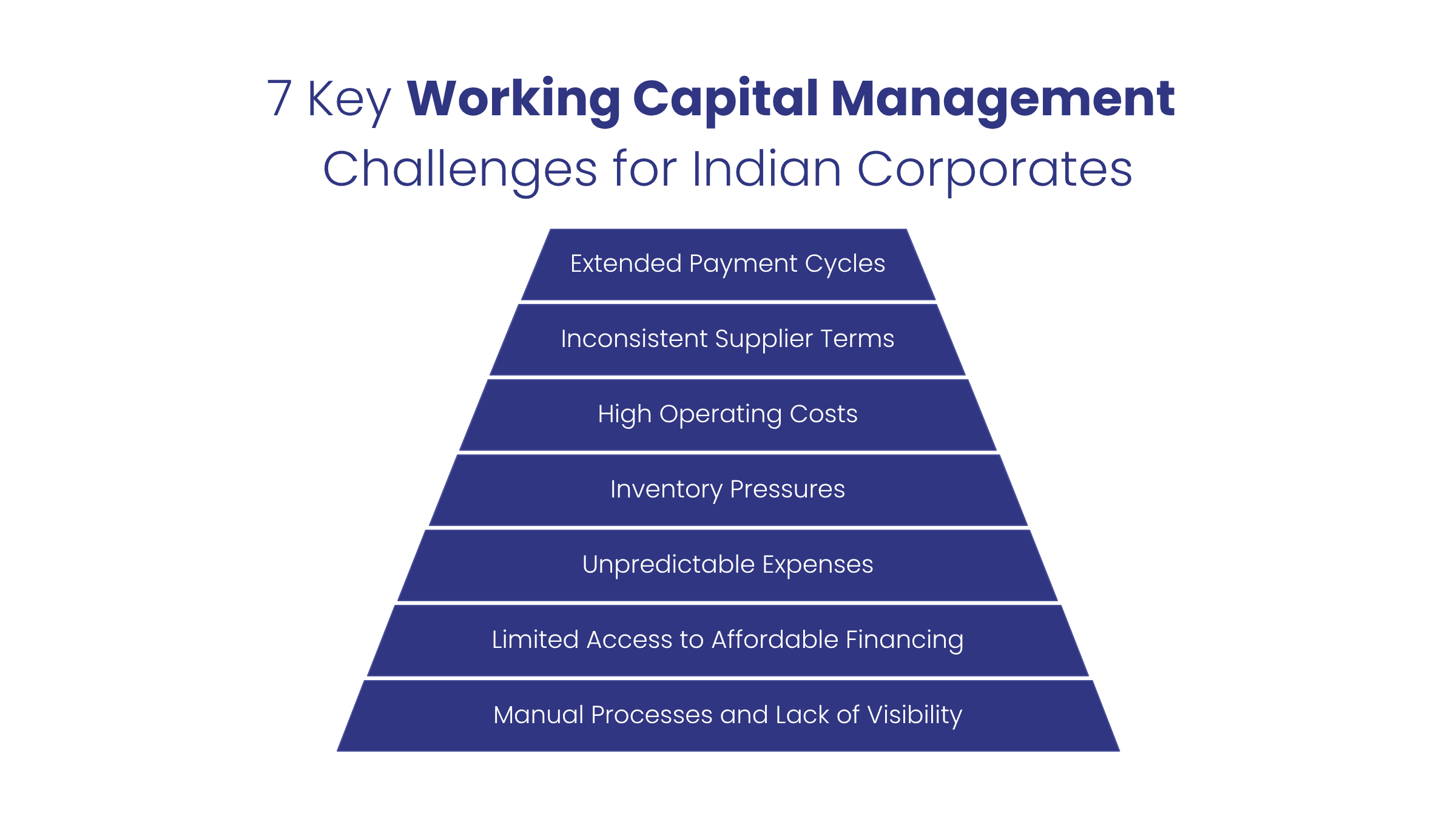

Challenges in Working Capital Management

1. Extended Payment Cycles: Indian corporates often face delayed customer payments, especially when dealing with large corporates, government contracts, or international buyers. Payment terms can extend to 60, 90, or even 120 days, which leads to significant cash flow gaps. This ties up cash and affects the company’s ability to reinvest or cover its own obligations.

2. Inconsistent Supplier Terms: Variations in supplier payment terms can make cash flow planning unpredictable. When suppliers expect faster payments, but customers delay theirs, businesses are left to bridge the gap, sometimes relying on costly short-term funding.

3. High Operating Costs: Rising costs, whether from wages, utilities, logistics, or compliance, place constant pressure on available cash. Even with steady revenues, increasing expenses can quickly narrow working capital buffers and limit flexibility.

4. Inventory Pressures: Managing inventory is a delicate balance. Excess stock ties up working capital and increases storage costs, while shortages risk lost sales and interrupted operations. Inaccurate demand forecasting or supply disruptions only add to the complexity.

5. Unpredictable Expenses: Unexpected costs, such as equipment breakdowns, regulatory changes, or volatile input prices, can suddenly alter cash flow requirements. Businesses may be forced into unplanned borrowing or deferred payments without adequate reserves.

6. Limited Access to Affordable Financing: Not all businesses have equal access to quick, cost-effective credit. Those without strong collateral or a long banking history may face higher borrowing costs or delays in securing the funds needed to smooth cash flow gaps.

7. Manual Processes and Lack of Visibility: Dependence on spreadsheets and manual workflows slows decision-making and increases the risk of errors. Without real-time visibility into cash positions, responding proactively to emerging issues is challenging.

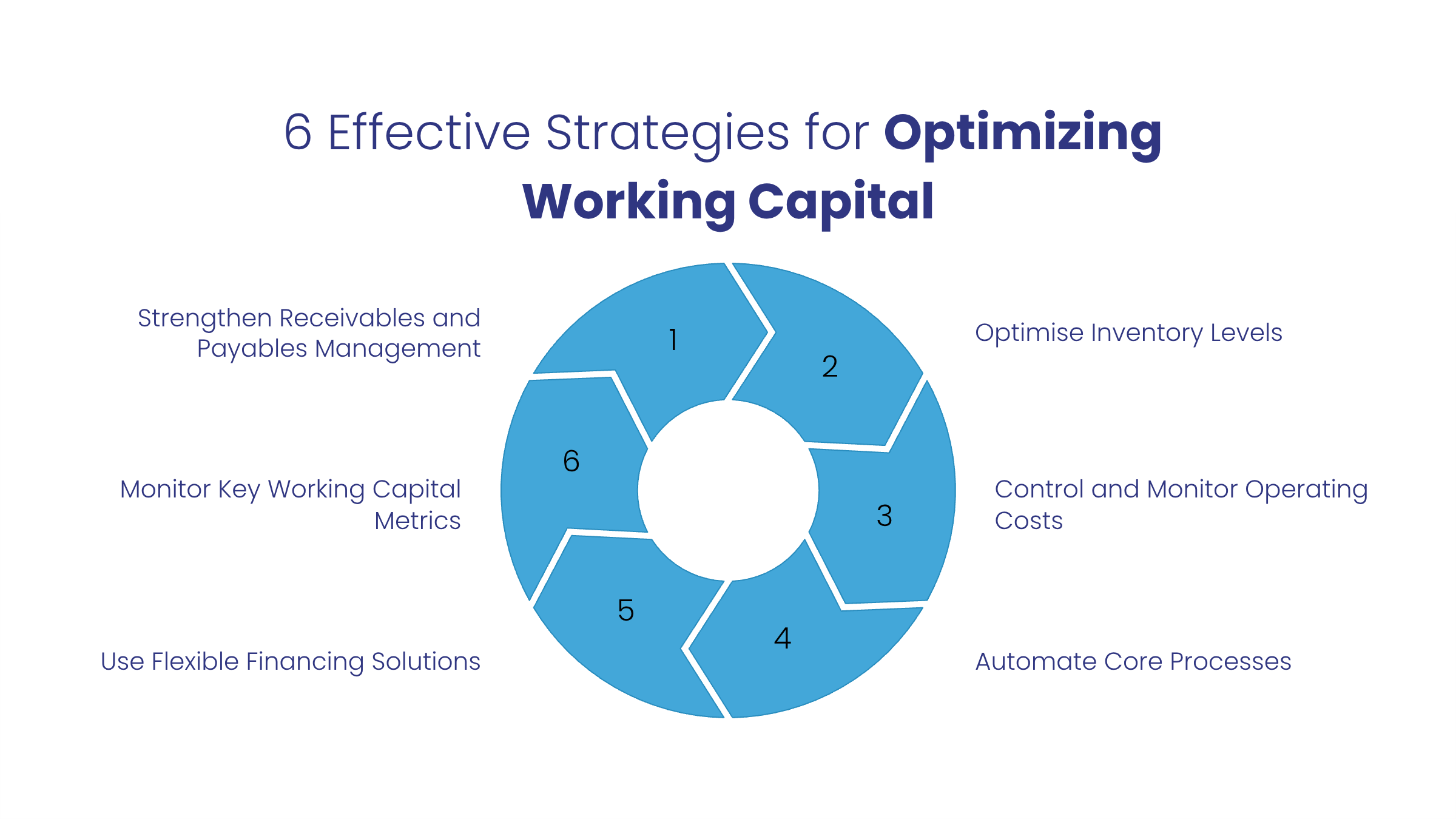

Strategies for Optimizing Working Capital

Effectively managing working capital is essential for maintaining liquidity and building financial resilience, especially when facing challenges such as long payment cycles, high operating costs, and market uncertainty. Indian corporates can adopt a combination of practical strategies rooted in discipline, data, and technology to keep cash moving efficiently and support growth.

1. Strengthen Receivables and Payables Management

Improving the speed and predictability of cash inflows and outflows is fundamental.

- Accelerate Collections: Send timely invoices, set clear payment terms, and follow up regularly on overdue accounts. Early payment incentives and automated reminders can encourage quicker payments.

- Assess Credit Risk: Review and update credit policies to minimize late payments and credit losses.

- Optimise Payables: Negotiate favorable terms with suppliers to extend payment periods when possible, without damaging relationships. Group purchasing and consolidating orders can sometimes lead to better rates.

2. Optimise Inventory Levels

Excess or outdated inventory ties up cash while understocking leads to missed sales.

- Just-in-Time & Demand Planning: Use demand forecasting and JIT ordering to keep inventory lean and responsive to market needs.

- Regular Inventory Reviews: Periodically assess stock for slow-moving or obsolete items to free up working capital.

- Leverage Technology: Real-time inventory management systems help track stock accurately and flag imbalances before they become costly.

3. Control and Monitor Operating Costs

- Expense Management: Routinely review fixed and variable operational expenses to identify cost-saving opportunities. Renegotiate contracts where possible and cut non-essential spending.

- Build a Contingency Buffer: Setting aside a cash reserve or line of credit helps you handle unexpected expenses or market shifts without disrupting operations.

4. Automate Core Processes

Manual, spreadsheet-driven processes slow down working capital cycles and increase risk.

- Digitise Invoicing and Payments: Automation speeds up billing, reduces administrative errors, and streamlines collections.

- Adopt Digital Payment Solutions: Faster, more reliable payments improve cash flow visibility and reduce delays.

- Supply Chain Finance Platforms: Leveraging next-gen platforms can unlock liquidity trapped in receivables, allowing businesses to access cash earlier and optimize cash flow.

5. Use Flexible Financing Solutions

- Invoice Discounting & Factoring: Turn receivables into immediate working capital by selling invoices to financial institutions or third-party SCF providers—without waiting for customer payments.

- Supply Chain Finance: It can bridge short-term gaps, strengthen supplier relationships, and reduce dependency on costly overdrafts.

6. Monitor Key Working Capital Metrics

Continuous measurement enables ongoing optimization and quicker course correction.

- Working Capital Ratio: Tracks whether current assets can cover short-term liabilities.

- Cash Conversion Cycle (CCC): Measures how quickly a business turns investments in inventory and receivables into cash.

- Days Sales Outstanding (DSO): Highlights how efficiently receivables are collected and where to focus for improvement.

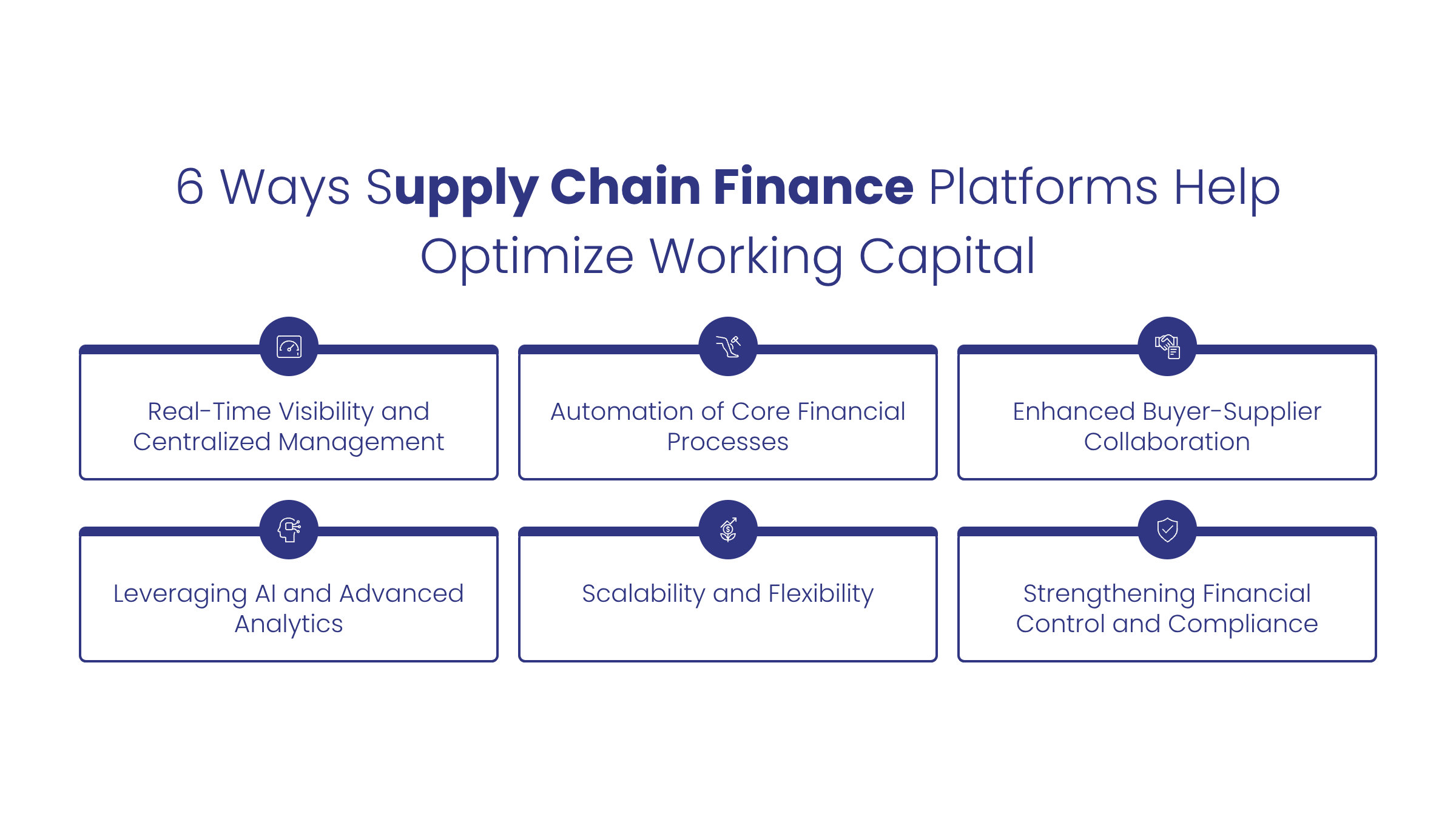

How Supply Chain Finance Platforms Can Help Optimize Working Capital

SCF platforms are transforming how businesses manage working capital, especially in industries with long payment cycles and complex supplier networks. By bringing together digital tools, automation, and advanced analytics, these platforms offer businesses a smarter, more agile way to unlock liquidity and keep cash flowing.

1. Real-Time Visibility and Centralized Management: SCF platforms provide a single digital environment for real-time monitoring of all aspects of working capital, including payables, receivables, and inventory. This integrated view replaces fragmented, manual tracking, enabling managers to make faster and better-informed decisions. Timely insights help identify bottlenecks and prevent liquidity gaps before they escalate.

2. Automation of Core Financial Processes: Manual invoicing, reconciliation, and payments can slow down operations and increase errors. Supply chain finance platforms automate these routine tasks, reducing administrative workload and the risk of mistakes. Automation also accelerates transactions, allowing businesses to convert receivables into cash sooner through solutions such as invoice discounting or early payment programs.

3. Enhanced Buyer-Supplier Collaboration: SCF solutions strengthen relationships across the supply chain by offering flexible financing options. Buyers can choose to extend payment terms without straining suppliers, while suppliers get access to early payments. This mutual benefit leads to a more stable supply chain and improved financial health for all parties involved.

4. Leveraging AI and Advanced Analytics: Modern SCF platforms use AI and machine learning for sharper forecasting, risk management, and credit assessment.

- Smarter Decision-Making: AI-driven analytics highlight trends, spot inefficiencies, and flag potential risks in receivables or inventory.

- Improved Cash Flow Forecasting: Predictive algorithms provide accurate cash flow projections based on real business data and market trends, helping companies plan ahead with confidence.

- Better Risk Management: Machine learning models assess customer and supplier creditworthiness, anticipate payment delays, and help set optimal credit terms.

5. Scalability and Flexibility: SCF platforms are designed to grow with a business. Whether expanding into new markets or navigating volatility, these platforms offer scalable solutions that can adapt to changing transaction volumes, supplier bases, and financial requirements without significant IT investment.

6. Strengthening Financial Control and Compliance: Digital workflows create audit trails and support regulatory compliance, making it easier for finance teams to track transactions, ensure accountability, and meet internal or external reporting requirements.

Conclusion: Enabling Smarter Working Capital Management

For Indian corporates, the complexity of modern supply chains requires more than traditional approaches to working capital. Incremental improvements in process and funding are no longer enough. What’s needed is the ability to manage liquidity with greater precision, transparency, and adaptability, especially as business environments and compliance demands evolve.

Loan Frame’s Supply Chain Finance platform is designed to address these realities through a unified digital interface that connects businesses with a broad network of top Indian banks and NBFCs. By digitizing workflows from billing to collections, the platform enables companies to manage their financing programs efficiently, automate routine tasks, and maintain real-time visibility across multiple lenders and supply chain partners.

The technology-driven approach ensures that each borrower is matched with the most suitable lender based on their unique credit profile and business needs. This leads to better program outcomes with minimal operational friction. With end-to-end scalability and data-driven insights, businesses gain more control over their working capital, positioning themselves to respond effectively to both challenges and opportunities.

Book a demo to see how a technology-led supply chain finance solution can streamline your working capital management.