Window shopping is taken very seriously by some shoppers when they visit markets or malls. This isn’t surprising when it comes without any costs attached. Not so much when you are in the market for a loan for your small business. Each window you stop at ends up making you and your small business a little less credit worthy.

A clean credit history, a track record of timely repayments, and impeccable relationships with lenders could easily be offset by serial window shopping. The result is that you end up paying a higher interest rate than someone with a credit profile similar to yours.

So how does casual scouting for loans result in higher costs?

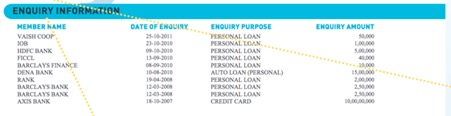

When you approach multiple lenders for your loan in a ‘spray & pray’ strategy, each evaluator will pull up your bureau score. Each such ‘bureau pull’ by these banks and NBFCs brings your score down if that enquiry does not result in an actual loan. The reason why the application did not get concluded into a loan is not relevant. You may have turned down the terms offered or postponed your borrowing decision, but still, this will be flagged and will count in your score calculation. In addition to this, there is an enquiry section in the bureau report that shows all loan enquiries made you with any lender. This again leads to creation of a poor perception leading to entirely avoidable pain.

Source: CIBIL Sample Report

The Problem

Online platforms for securing business loans have proliferated in recent times. These offer a convenient service for both lenders and small businesses in terms of loan origination. Often times, these companies are actually doing you more harm than good – the moment you apply on their websites, they forward your application simultaneously to multiple banks and NBFCs in a Scattershot Strategy. This indiscriminate spreading of your loan application then leads to multiple pulls of your bureau report. Imagine the collateral damage done by this open broadcasting! Banks are also very wary of lending to someone whose bureau report shows multiple enquiries in the recent past. Another problem not necessarily relating to cost of funding that arises is that multiple enquiries invite unnecessary queries from lenders, which increases your administrative costs and needlessly wastes your time.

The Solution

One solution is for you to get your own bureau report because that does not impact your score. However, many banks and NBFCs do not rely on reports retrieved by customers. So they almost invariably pull it themselves.

At Loan Frame, we assist small businesses like yours in getting their own bureau reports, which helps preserve their credit score. In addition to this, we NEVER broadcast an application. We expend a lot of effort in studying each application thoroughly including reviewing the financial and bank statements. This helps us to understand the true merits of an application and know exactly which lender is best suited for an applicant’s business loan needs. Our proprietary ‘LenderMatch’ algorithm logs and retrieves policies of multiple lenders across the country and is able to connect small business loan applicants to the right lender. This matching, combined with a rigorous process of hand holding to ensure that the documentation is up to the mark leads to a higher willingness by the lender to accept a credit score pulled by the applicant.

In this way, not only does the chance of success of small businesses go up, but they are also in complete control of their bureau score, which in turn leads to approved loans at reasonable cost.

Contact Loan Frame now for personalised advice on how to get the best interest rate either for your new loan or for refinancing your existing loan at a lower rate. We have solutions for small and medium businesses from all sectors and for all types of loans.